Calculating California Maintenance (Alimony)

Learn how to make California maintenance (alimony) calculations using the California Maintenance Calculator.

Go CalculateUsing the California Maintenance Calculator

The California Maintenance (Alimony) Calculator makes California temporary maintenance calculations. To calculate temporary maintenance amounts, the California Maintenance Calculator (1) determines the spouses' net incomes by subtracting United States and California income tax from the spouses' gross incomes, (2) applies any additional deductions to the net incomes such as child support and related expenses, and (3) applies the selected California maintenance formula to the spouses' net incomes. Although the California Maintenance Calculator does all this for you with one click of the mouse, you must enter relevant information into the calculator.

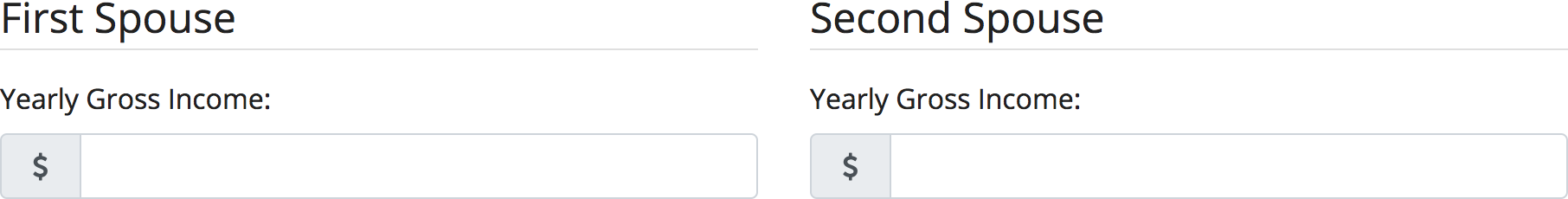

Step 1: Enter the Gross Incomes

First, you must enter the spouses' gross incomes. Enter the gross incomes into the appropriate inputs in the California Maintenance Calculator form. The gross incomes should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The California Maintenance Calculator uses the gross incomes entered into the calculator inputs to calculate the spouses' net incomes. The spouses' net incomes are calculated by subtracting United States and California income tax from the spouses' gross incomes and applying any additional deductions to the net incomes such as child support and related expenses.

Step 2: Select the Income Tax Filing Statuses

Second, you must select the spouses' income tax filing statuses. The tax filing statuses correspond to the available United States and California filing statuses. The available statuses are: single, head of household, married filing jointly, and married filing separately.

The California Maintenance Calculator uses the selected income tax filing statuses to calculate the spouses' United States and California income tax. Each spouse's income tax is subtracted from their gross income to determine their net income.

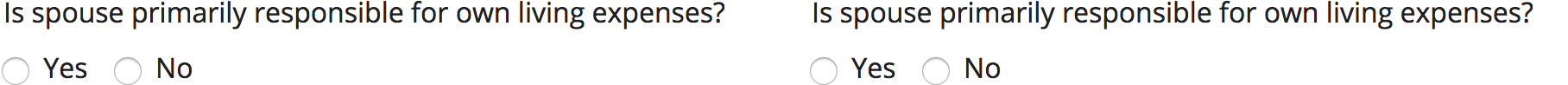

Step 3: Choose Whether Spouse is Responsible for Own Expenses

Third, you must choose whether each spouse is primarily responsible for their own living expenses. Choose from one of the two available options.

If a spouse is primarily responsible for their own living expenses, then the spouse is entitled to take a personal exemption for California income tax purposes, and the California Maintenance Calculator reduces the spouse's overall California income tax liability after California income tax has been calculated. The amount of the California personal exemption credit is $114.00.

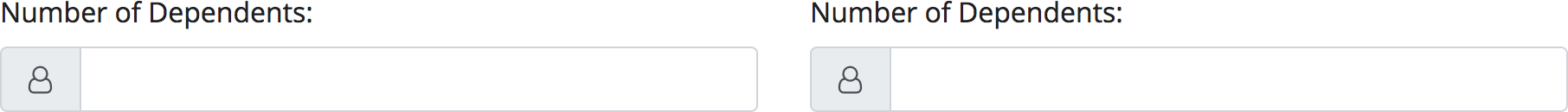

Step 4: Enter the Number of Dependents

Fourth, you must enter the number of dependents for each spouse. Enter the number of dependents into the appropriate inputs in the California Maintenance Calculator form. The number of dependents should be entered as integer values with no letters or special characters.

The California Maintenance Calculator uses the number of dependents entered into the calculator inputs to calculate the California income tax dependent exemption amount. The California Maintenance Calculator reduces a spouse's overall California income tax liability after California income tax has been calculated by $353.00 per dependent.

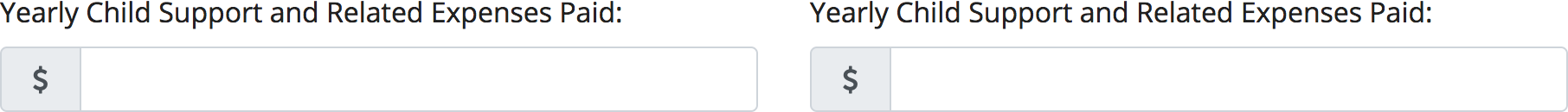

Step 5: Enter the Child Support and Related Expenses

Fifth, you must enter the amount that each spouse pays for child support and related expenses. Enter the child support and related expenses into the appropriate inputs in the California Maintenance Calculator form. The amounts should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The California Maintenance Calculator uses the child support and related expenses entered into the calculator inputs to further reduce the spouses' net incomes. Maintenance is calculated on net income not allocated to child support and related expenses.

Step 6: Enter the Marriage Length

Sixth, you must enter the length of the spouses' marriage. Once you have determined the marriage length, enter the length into the appropriate input in the California Maintenance Calculator form. The length should be entered in years with no letters or special characters.

The California Maintenance Calculator uses the marriage length entered into the calculator input to calculate the California maintenance duration. Although there is no maintenance duration formula provided for by California law, the general rule-of-thumb in California is for the maintenance duration to last one-half the lenght of the marriage.

Step 7: Select a Maintenance Formula

Seventh, you must select a California temporary maintenance formula from the available formulas. The California Maintenance Calculator allows you to choose from the three California county formulas that have been provided for by local court rule. Those counties are: Alameda County, Marin County, and Santa Clara County.

The California Maintenance Calculator uses the selected temporary maintenance formula for your California maintenance calculation. Each county has a different temporary maintenance formula. The Santa Clara County formula has gained the most wide-spread adoption throughout California.

Alameda County Alimony Formula

Alameda County local court rules provide the Alameda County temporary maintenance formula. Under the Alameda formula, the amount of maintenance is dependent on whether the maintenance recipient is also receiving child support from the maintenance payor.

In cases where the maintenance recipient is not receiving child support from the maintenance payor, the amount of maintenance is calculated by taking 40% of the paying spouse's net income minus 50% of the recipient spouse's net income. In cases where the maintenance recipient is also receiving child support from the maintenance payor, the amount of maintenance is calculated by taking 35% of the paying spouse's net income (after deduction of child support) minus 40% of the recipient spouse's net income (without addition of child support).

El Dorado County Alimony Formula

El Dorado County local court rules provide the El Dorado County temporary maintenance formula. The El Dorado formula is a hybrid formula in that it provides a general maintenance formula and then defers to the Alameda County formula if child support is paid by one supporting parent for children of the relationship.

Under the El Dorado formula, temporary maintenance awards are calculated by taking 40% of the supporting spouse’s net income minus 50% of the supported spouse’s net income. However, if child support is paid by one supporting parent for children of the relationship, temporary maintenance awards are calculated according to the formula adopted by Alameda County.

Humboldt County Alimony Formula

Humboldt County local court rules provide the Humboldt County temporary maintenance formula.

Inyo County Alimony Formula

Inyo County local court rules provide the Inyo County temporary maintenance formula.

Lake County Alimony Formula

Lake County local court rules provide the Lake County temporary maintenance formula. Under the Lake County formula, the amount of maintenance is calculated by taking 40% of the paying spouse's net income minus 50% of the recipient spouse's net income, adjusted for the tax consequences.

Marin County Alimony Formula

Marin County local court rules provide the Marin County temporary maintenance formula. Under the Marin formula, the amount of maintenance is dependent on whether the maintenance recipient is also receiving child support from the maintenance payor.

In cases where the maintenance recipient is not receiving child support from the maintenance payor, the amount of maintenance is calculated by taking 40% of the paying spouse's net income minus 50% of the recipient spouse's net income. In cases where the maintenance recipient is also receiving child support from the maintenance payor, the amount of maintenance is calculated by taking 35% of the paying spouse's net income (after deduction of child support) minus 45% of the recipient spouse's net income (without addition of child support).

San Mateo County Alimony Formula

San Mateo County local court rules provide the San Mateo County temporary maintenance formula. Temporary spousal support is generally computed by taking 40% of the net income of the payor, minus 50% of the net income of the payee, adjusted for tax consequences. In the event there is child support, temporary spousal support is calculated on the net income not allocated to child support and/or child-related expenses.

Santa Barbara County Alimony Formula

Santa Barbara County local court rules provide the Santa Barbara County temporary maintenance formula. Under the Santa Barbara formula, the amount of maintenance is calculated by taking 40% of the net income of the payor, minus 50% of the net income of the payee, adjusted for tax consequences. If there is child support, temporary spousal or partner support is calculated on net income not allocated to child support and/or child-related expenses. This formula is modeled after the Santa Clara temporary maintenance formula.

Santa Clara County Alimony Formula

Santa Clara County local court rules provide the Santa Clara County temporary maintenance formula. Under the Santa Clara formula, the amount of maintenance is calculated by taking 40% of the net income of the payor, minus 50% of the net income of the payee, adjusted for tax consequences. If there is child support, temporary spousal or partner support is calculated on net income not allocated to child support and/or child-related expenses.

Other County Alimony Formulas

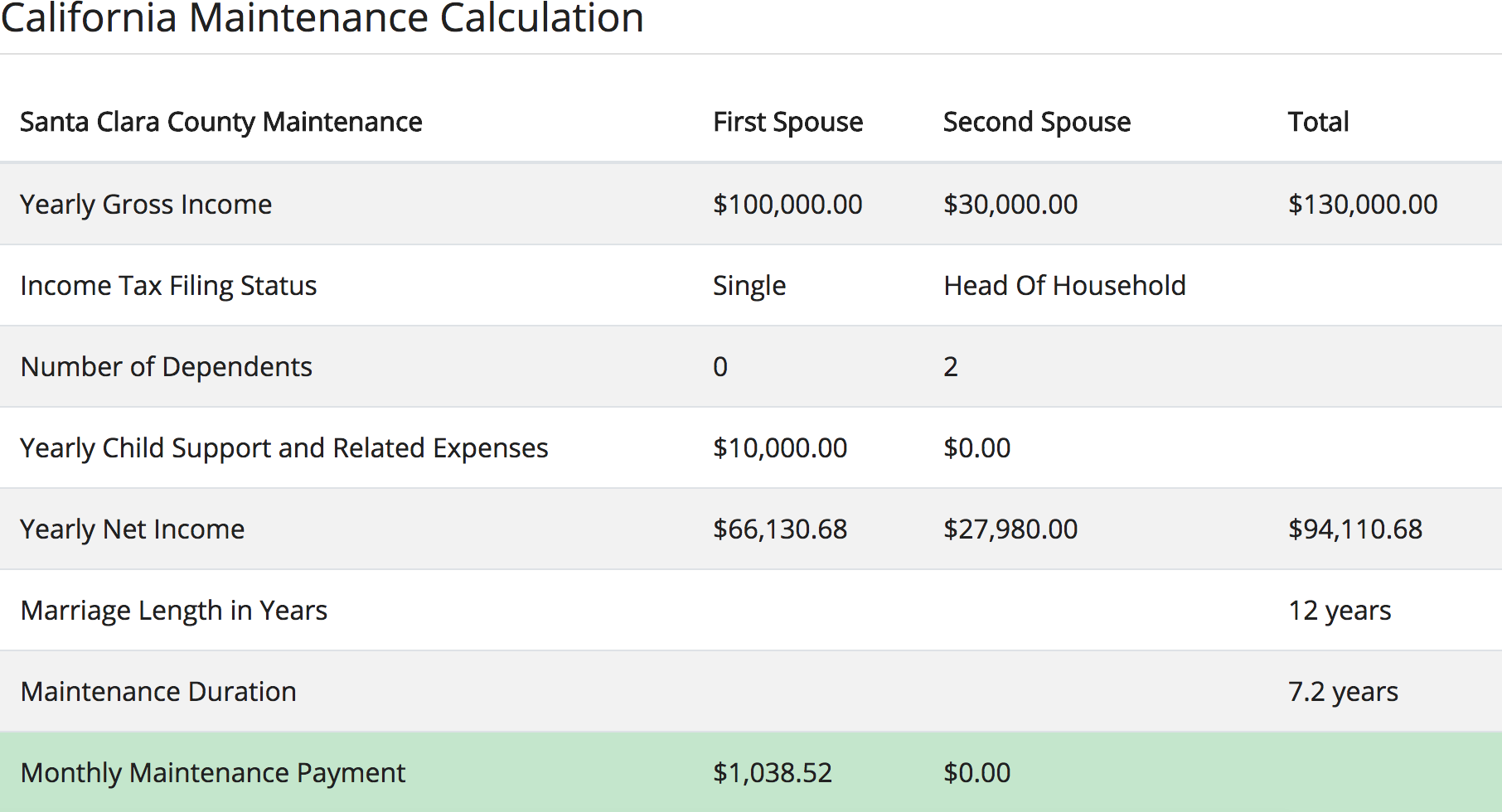

Step 8: Make the Calculation

Once the spouses' information been entered into the California Maintenance Calculator and a maintenance formula has been selected, click the "Calculate Alimony" button. That's it! Your California maintenance calculation will display on the page underneath the California Maintenance Calculator.

The California maintenance calculation result is based on the selected county formula and contains the relevant information for your maintenance calculation.

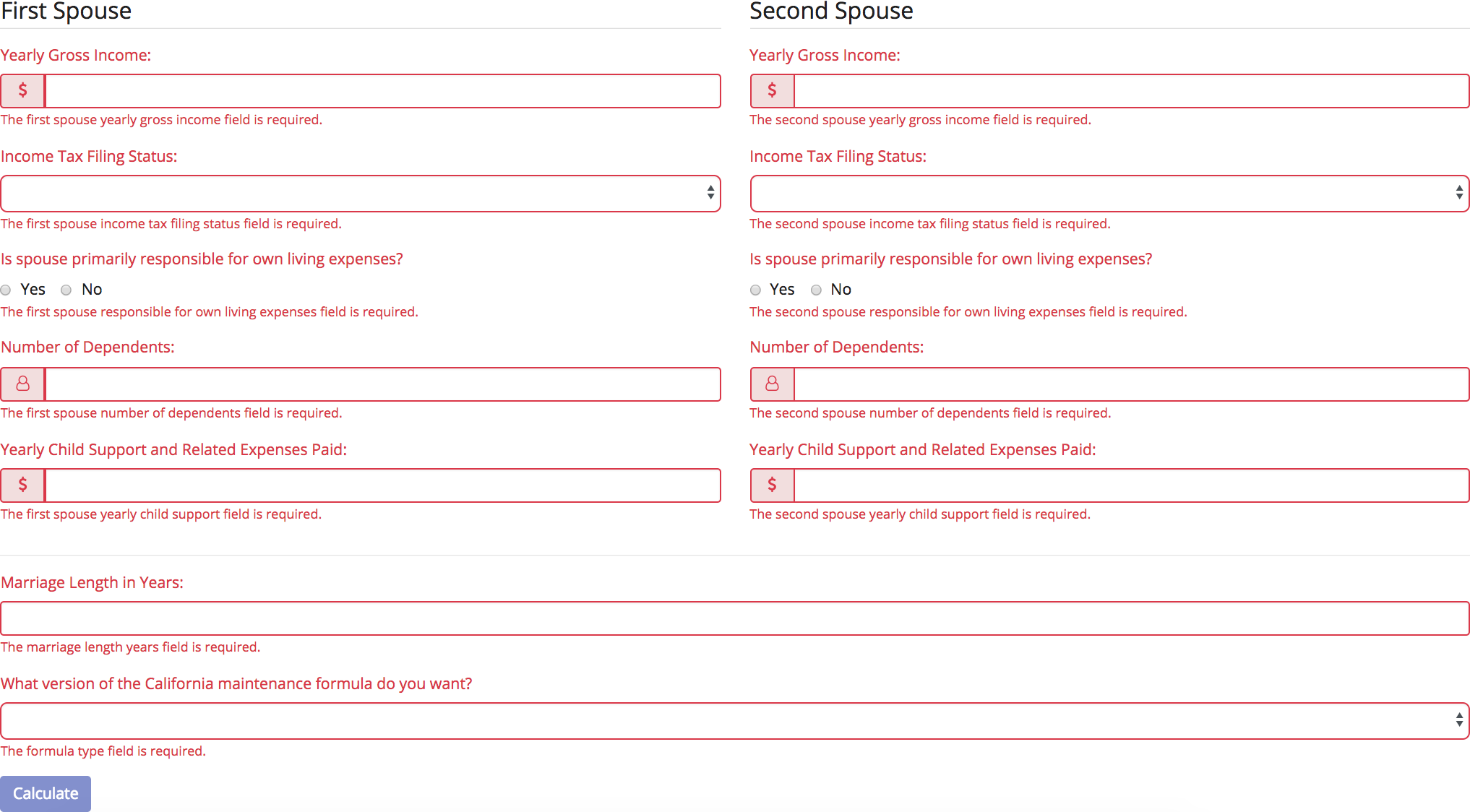

Validation Errors

If the California Maintenance Calculator was submitted with invalid information, the calculator will display validation errors on the calculator inputs that were filled out incorrectly and the "Calculate Alimony" button will be disabled. Also, error messages will be displayed below the inputs that indicate the reasons for the errors.

If you receive validation errors, enter valid information into the calculator inputs that contain the validation errors. Upon entry of new information, the validation error will be removed from the updated calculator input. Once all validation errors have been removed, the "Calculate Alimony" button will be re-enabled for resubmission of the California Maintenance (Alimony) Calculator.