Calculating Colorado Maintenance (Alimony)

Learn how to make Colorado maintenance (alimony) calculations using the Colorado Maintenance Calculator.

Go CalculateIntroduction to the Colorado Maintenance Guidelines

The Colorado Maintenance (Alimony) Calculator makes Colorado guideline maintenance calculations with one click of the mouse. However, because the Colorado Maintenance Calculator allows you to select from two different versions of the Colorado maintenance guidelines, you must first understand the different versions before you can effectively use the Colorado Maintenance Calculator.

Version 1: Effective January 1, 2014, through August 7, 2018

On May 10, 2013, the State of Colorado approved House Bill 13-1058. This law became effective January 1, 2014, and provides formulas to calculate both maintenance amounts and durations. This law is commonly referred to as the "Colorado maintenance guidelines." Under the 2014 law, a court is required to make findings concerning the guideline amount and duration of maintenance if the length of the spouses' marriage is at least 3 years and the spouses' combined, annual adjusted gross income does not exceed $360,000.

2014 Amount Formula

Under the 2014 Colorado maintenance guidelines, the amount of maintenance is equal to 40% of the higher income spouse's monthly adjusted gross income minus 50% of the lower income spouse's monthly adjusted gross income; except that, when added to the gross income of the recipient, shall not result in the recipient receiving in excess of 40% of the spouses' combined monthly adjusted gross income.

2014 Adjusted Gross Income

Under the 2014 Colorado maintenance guidelines, "adjusted gross income" is defined as gross income minus (1) preexisting court-ordered child support obligations actually paid by a spouse, (2) preexisting court-ordered alimony or maintenance obligations actually paid by a spouse, and (3) the adjustment to a spouse's income as determined pursuant to Section 115(6)(b)(I) of the Uniform Dissolution of Marriage Act, for any children who are not children of the marriage for whom the spouse has a legal responsibility to support.

2014 Duration Formula

Under the 2014 Colorado maintenance guidelines, the duration of maintenance, for marriages of at least 3 years in length but not more than 20 years in length, is set forth in the table contained below.

| Length of the Marriage | Guideline Maintenance Duration |

|---|---|

| 36 months | 11 months |

| 37 months | 12 months |

| 38 months | 12 months |

| 39 months | 12 months |

| 40 months | 13 months |

| 41 months | 13 months |

| 42 months | 13 months |

| 43 months | 14 months |

| 44 months | 14 months |

| 45 months | 15 months |

| 46 months | 15 months |

| 47 months | 15 months |

| 48 months | 16 months |

| 49 months | 16 months |

| 50 months | 17 months |

| 51 months | 17 months |

| 52 months | 18 months |

| 53 months | 18 months |

| 54 months | 18 months |

| 55 months | 19 months |

| 56 months | 19 months |

| 57 months | 20 months |

| 58 months | 20 months |

| 59 months | 21 months |

| 60 months | 21 months |

| 61 months | 21 months |

| 62 months | 22 months |

| 63 months | 22 months |

| 64 months | 23 months |

| 65 months | 23 months |

| 66 months | 24 months |

| 67 months | 24 months |

| 68 months | 25 months |

| 69 months | 25 months |

| 70 months | 26 months |

| 71 months | 26 months |

| 72 months | 27 months |

| 73 months | 27 months |

| 74 months | 28 months |

| 75 months | 28 months |

| 76 months | 29 months |

| 77 months | 29 months |

| 78 months | 30 months |

| 79 months | 30 months |

| 80 months | 31 months |

| 81 months | 31 months |

| 82 months | 32 months |

| 83 months | 32 months |

| 84 months | 33 months |

| 85 months | 33 months |

| 86 months | 34 months |

| 87 months | 34 months |

| 88 months | 35 months |

| 89 months | 35 months |

| 90 months | 36 months |

| 91 months | 37 months |

| 92 months | 37 months |

| 93 months | 38 months |

| 94 months | 38 months |

| 95 months | 39 months |

| 96 months | 39 months |

| 97 months | 40 months |

| 98 months | 41 months |

| 99 months | 41 months |

| 100 months | 42 months |

| 101 months | 42 months |

| 102 months | 43 months |

| 103 months | 43 months |

| 104 months | 44 months |

| 105 months | 45 months |

| 106 months | 45 months |

| 107 months | 46 months |

| 108 months | 46 months |

| 109 months | 47 months |

| 110 months | 48 months |

| 111 months | 48 months |

| 112 months | 49 months |

| 113 months | 50 months |

| 114 months | 50 months |

| 115 months | 51 months |

| 116 months | 51 months |

| 117 months | 52 months |

| 118 months | 53 months |

| 119 months | 53 months |

| 120 months | 54 months |

| 121 months | 55 months |

| 122 months | 55 months |

| 123 months | 56 months |

| 124 months | 57 months |

| 125 months | 57 months |

| 126 months | 58 months |

| 127 months | 59 months |

| 128 months | 59 months |

| 129 months | 60 months |

| 130 months | 61 months |

| 131 months | 61 months |

| 132 months | 62 months |

| 133 months | 63 months |

| 134 months | 63 months |

| 135 months | 64 months |

| 136 months | 65 months |

| 137 months | 66 months |

| 138 months | 66 months |

| 139 months | 67 months |

| 140 months | 68 months |

| 141 months | 68 months |

| 142 months | 69 months |

| 143 months | 70 months |

| 144 months | 71 months |

| 145 months | 71 months |

| 146 months | 72 months |

| 147 months | 73 months |

| 148 months | 74 months |

| 149 months | 74 months |

| 150 months | 75 months |

| 151 months | 76 months |

| 152 months | 76 months |

| 153 months | 77 months |

| 154 months | 77 months |

| 155 months | 78 months |

| 156 months | 78 months |

| 157 months | 79 months |

| 158 months | 79 months |

| 159 months | 80 months |

| 160 months | 80 months |

| 161 months | 81 months |

| 162 months | 81 months |

| 163 months | 82 months |

| 164 months | 82 months |

| 165 months | 83 months |

| 166 months | 83 months |

| 167 months | 84 months |

| 168 months | 84 months |

| 169 months | 85 months |

| 170 months | 85 months |

| 171 months | 86 months |

| 172 months | 86 months |

| 173 months | 87 months |

| 174 months | 87 months |

| 175 months | 88 months |

| 176 months | 88 months |

| 177 months | 89 months |

| 178 months | 89 months |

| 179 months | 90 months |

| 180 months | 90 months |

| 181 months | 91 months |

| 182 months | 91 months |

| 183 months | 92 months |

| 184 months | 92 months |

| 185 months | 93 months |

| 186 months | 93 months |

| 187 months | 94 months |

| 188 months | 94 months |

| 189 months | 95 months |

| 190 months | 95 months |

| 191 months | 96 months |

| 192 months | 96 months |

| 193 months | 97 months |

| 194 months | 97 months |

| 195 months | 98 months |

| 196 months | 98 months |

| 197 months | 99 months |

| 198 months | 99 months |

| 199 months | 100 months |

| 200 months | 100 months |

| 201 months | 101 months |

| 202 months | 101 months |

| 203 months | 102 months |

| 204 months | 102 months |

| 205 months | 103 months |

| 206 months | 103 months |

| 207 months | 104 months |

| 208 months | 104 months |

| 209 months | 105 months |

| 210 months | 105 months |

| 211 months | 106 months |

| 212 months | 106 months |

| 213 months | 107 months |

| 214 months | 107 months |

| 215 months | 108 months |

| 216 months | 108 months |

| 217 months | 109 months |

| 218 months | 109 months |

| 219 months | 110 months |

| 220 months | 110 months |

| 221 months | 111 months |

| 222 months | 111 months |

| 223 months | 112 months |

| 224 months | 112 months |

| 225 months | 113 months |

| 226 months | 113 months |

| 227 months | 114 months |

| 228 months | 114 months |

| 229 months | 115 months |

| 230 months | 115 months |

| 231 months | 116 months |

| 232 months | 116 months |

| 233 months | 117 months |

| 234 months | 117 months |

| 235 months | 118 months |

| 236 months | 118 months |

| 237 months | 119 months |

| 238 months | 119 months |

| 239 months | 120 months |

| 240 months | 120 months |

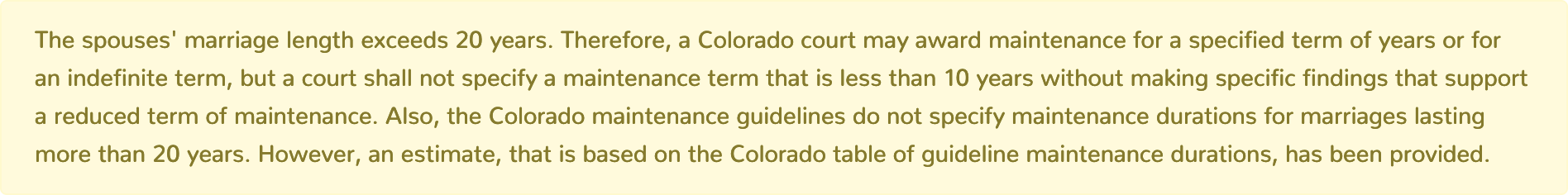

The 2014 Colorado maintenance guidelines provide that when the marriage length exceeds 20 years, a court may award maintenance for a specified duration of years or for an indefinite duration, but a court shall not specify a maintenance duration that is less than 10 years without making specific findings that support a reduced duration of maintenance. The 2014 Colorado maintenance guidelines do not specify maintenance durations for marriages of less than 3 years in length.

Version 2: Effective August 8, 2018, through Present

On May 24, 2018, the State of Colorado approved House Bill 18-1385. This law became effective August 8, 2018, decreases the adjusted gross income upper limit, and accounts for the repeal of the deduction for alimony payments under the Tax Cuts and Jobs Act. Under the 2018 law, a court is required to make findings concerning the guideline amount and duration of maintenance if the spouses' combined, annual adjusted gross income does not exceed $240,000. The 2018 law did not change the formula for calculating Colorado guideline maintenance durations.

2018 Amount Formula

Under the 2018 Colorado maintenance guidelines, calculating the maintenance amount is a two-step process. First, calculate the base amount of maintenance. The base amount is equal to 40% of the spouses' combined, monthly adjusted gross income minus the lower income spouse's monthly adjusted gross income. If the calculation results in a negative number, the base amount is zero.

Second, normalize the base amount of maintenance between the different income tax treatments. If the maintenance award is deductible for federal income tax purposes by the maintenance payor and taxable income to the maintenance recipient, then the actual maintenance amount is equal to the full base amount. Otherwise, if the maintenance award is not deductible for federal income tax purposes by the maintenance payor and not taxable income to the maintenance recipient, then the actual maintenance amount is equal to a percentage of the base amount, which is determined by the spouses' combined monthly adjusted gross income as follows:

| Combined Monthly Adjusted Gross Income | Base Amount Percentage |

|---|---|

| $10,000 or less | 80% |

| More than $10,000 but not more than $20,000 | 75% |

2018 Adjusted Gross Income

Under the 2018 Colorado maintenance guidelines, the preexisting alimony income adjustment is normalized between the different income tax treatments. If the preexisting court-ordered alimony obligation actually paid by a spouse is deductible for federal income tax purposes by that spouse, then the full amount of alimony actually paid is deducted from that spouse's gross income. Otherwise, if the preexisting court-ordered alimony obligation actually paid by a spouse is not deductible for federal income tax purposes by that spouse, then the amount of alimony actually paid by that spouse multiplied by 1.25 is deducted from that spouse's gross income.

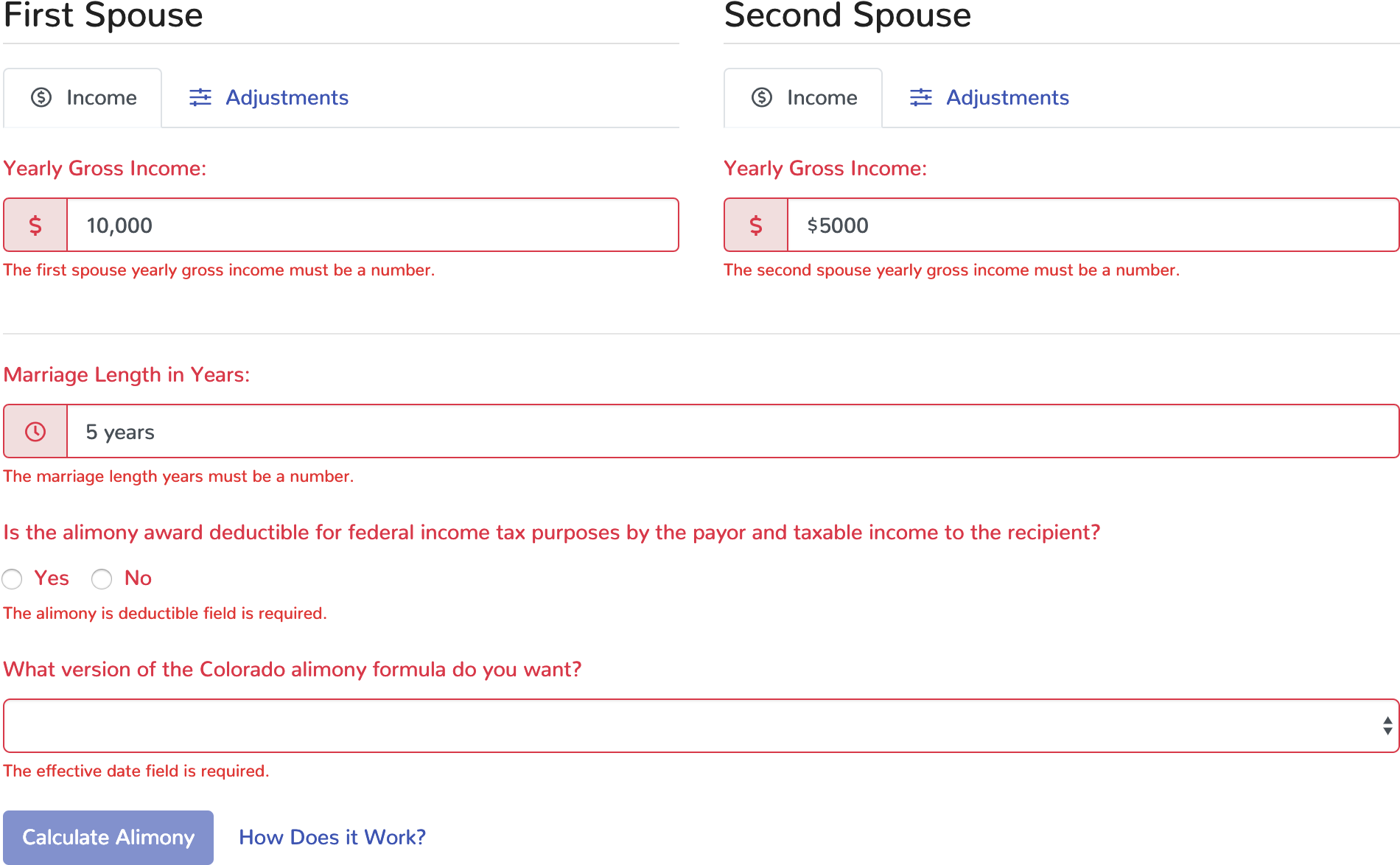

Using the Colorado Maintenance Calculator

Once you understand the basics of the Colorado maintenance advisory guidelines, you are ready to use the Colorado Maintenance (Alimony) Calculator. To calculate Colorado guideline maintenance, you must enter gross income, income adjustment, marriage length, and tax treatment information into the calculator and you must select a version of the Colorado maintenance guidelines.

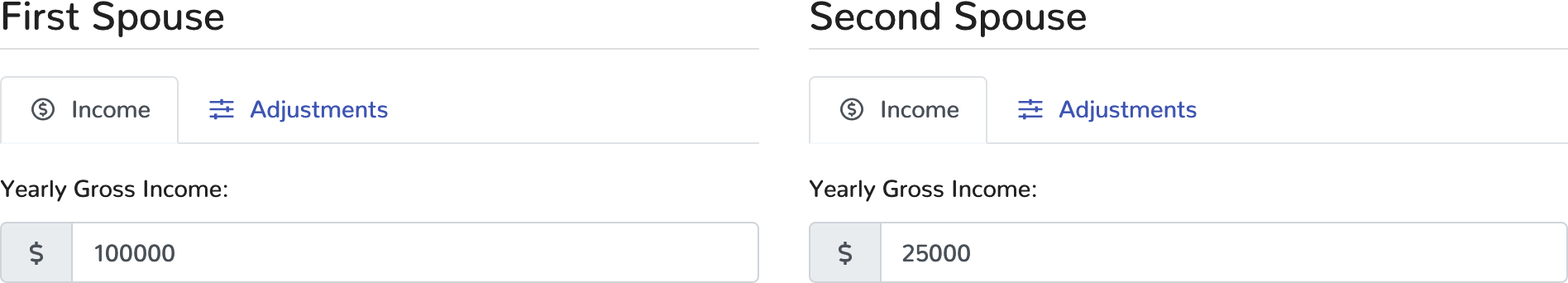

Step 1: Enter the Gross Incomes

First, you must enter the spouses' yearly gross incomes. Enter the gross incomes into the appropriate inputs in the Colorado Maintenance Calculator form. The gross incomes should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Colorado Maintenance Calculator uses the gross incomes entered into the calculator inputs to determine the spouses' adjusted gross incomes and calculate the Colorado guideline maintenance amount. To calculate Colorado guideline maintenance amounts, the Colorado Maintenance Calculator uses the applicable amount formula for the version of Colorado maintenance guidelines that you select. There are two different versions of the Colorado maintenance guidelines that you must select from.

Combined Adjusted Gross Income Greater Than $240,000

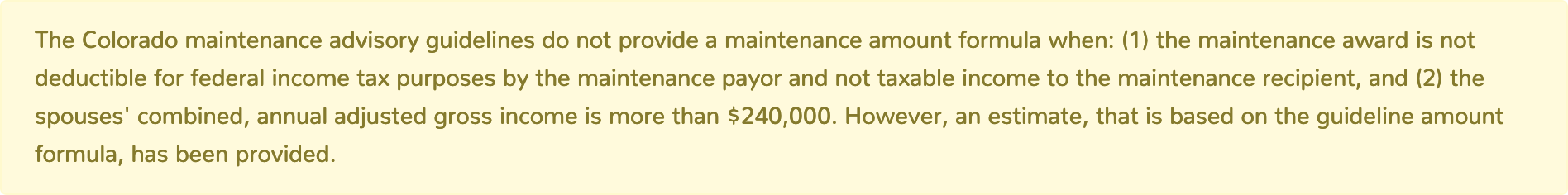

The 2018 Colorado maintenance guidelines do not specify a maintenance normalization percentage when: (1) the maintenance award is deductible for federal income tax purposes by the maintenance payor and taxable income to the maintenance recipient, and (2) the spouses' combined, annual adjusted gross income is greater than $240,000. In that situation, the Colorado Maintenance Calculator multiplies the base amount of maintenance by 75% to arrive at the actual maintenance amount. The following alert message will also be displayed above the maintenance calculation.

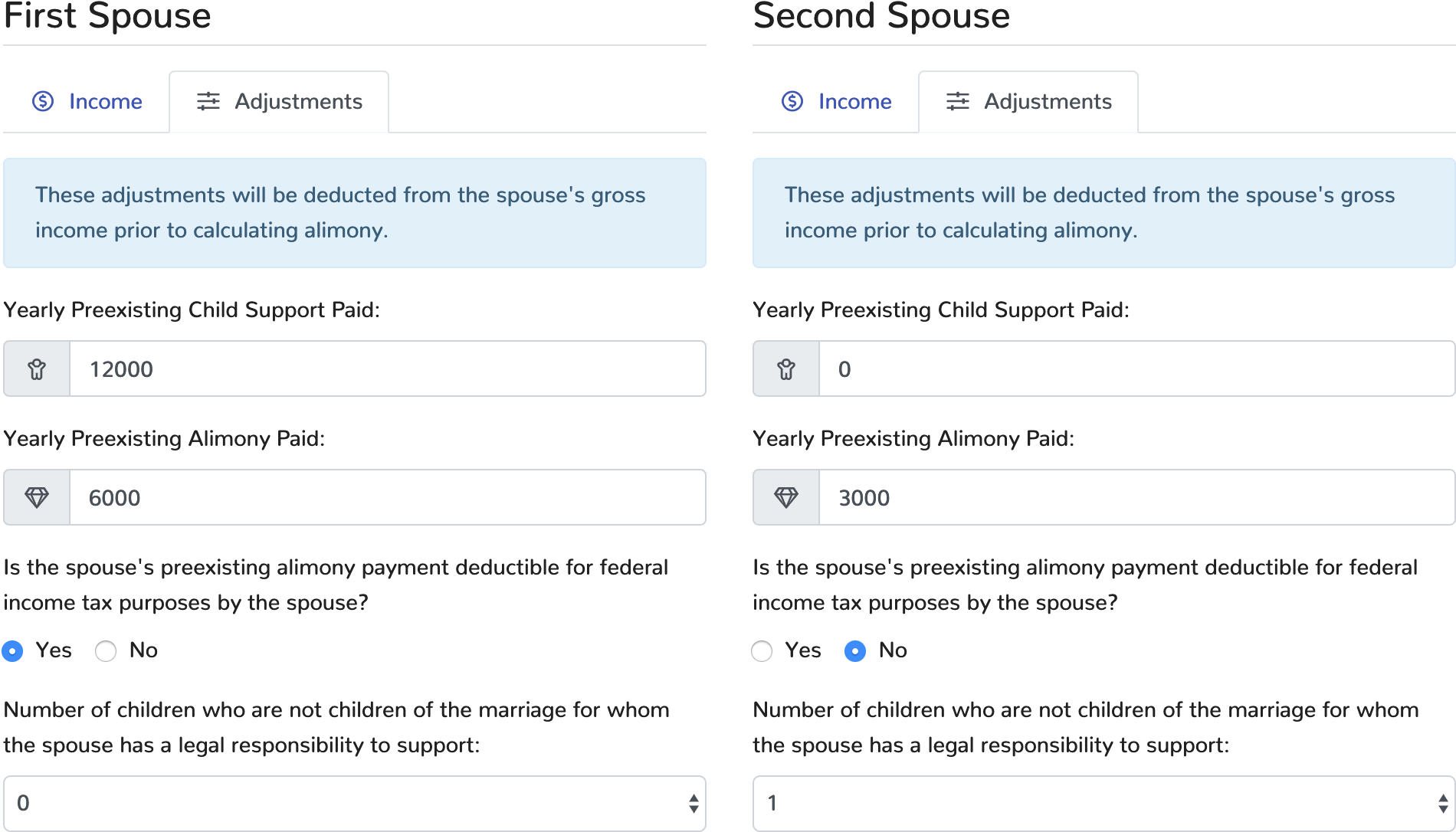

Step 2: Enter the Income Adjustments

Second, you may enter any adjustments to gross income that either spouse may claim. If applicable, click on the "Adjustments" tab and enter the relevant information into the appropriate input in the Colorado Maintenance Calculator form. Each income adjustment has been defaulted to zero.

Preexisting Child Support Adjustment

The preexisting child support income adjustment applies when a spouse, pursuant to a court order, is paying child support for any children of the marriage. The yearly amount paid should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas. Any amount entered for this adjustment will be subtracted from the spouse's gross income prior to calculating maintenance.

Preexisting Alimony Adjustment

The preexisting alimony income adjustment applies when a spouse, pursuant to a court order, is paying alimony for a prior spouse not of the marriage. The yearly amount paid should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas. If any amount is entered for the preexisting alimony adjustment, then you must choose whether the spouse's preexisting alimony payment is deductible for federal income purposes by the spouse. Any amount entered for this adjustment will be normalized (if necessary) and subtracted from the spouse's gross income prior to calculating maintenance.

Other Supported Children Adjustment

The other supported children income adjustment applies when a spouse has a legal responsibility to support any children who are not children of the marriage, such as children from a prior relationship. The total number of other supported children should be selected from the select menu. The Colorado Maintenance Calculator will automatically determine the proper adjustment to the spouse's income based on Section 115(6)(b) of the Uniform Dissolution of Marriage Act. This amount will be subtracted from the spouse's gross income prior to calculating maintenance.

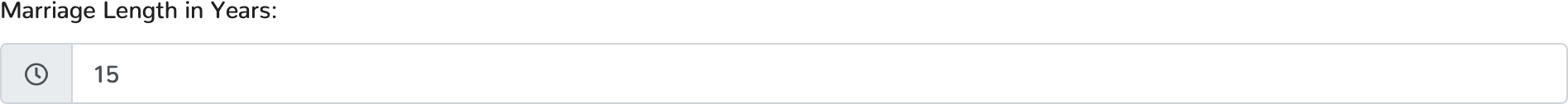

Step 3: Enter the Marriage Length

Third, you must enter the length of the spouses' marriage. The marriage length is the period of time from the first day of the month following the date of the spouses' marriage until the date of the divorce decree or the date of the hearing on division of property if such hearing precedes the date of the decree. Once you have determined the marriage length, enter the length into the appropriate input in the Colorado Maintenance Calculator form. The length should be entered in years with no letters or special characters.

The Colorado Maintenance Calculator uses the marriage length entered into the calculator input to calculate the Colorado guideline maintenance duration. To calculate Colorado guideline maintenance durations, the Colorado Maintenance Calculator uses the applicable duration formula for the version of Colorado maintenance guidelines that you select. There are two different versions of the Colorado maintenance guidelines that you must select from.

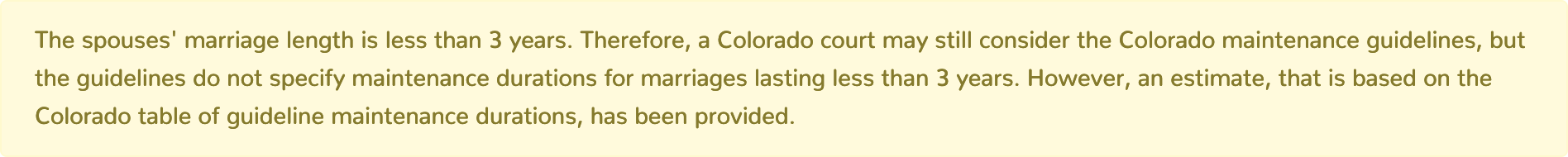

Marriage Length Less Than 3 Years

Because the Colorado maintenance guidelines do not specify maintenance durations for marriages of less than 3 years in length, the Colorado Maintenance Calculator uses extrapolation to estimate maintenance durations for marriages of less than 3 years in length. The following table displays the values that the Colorado Maintenance Calculator uses to estimate maintenance durations for marriages of less than 3 years in length.

| Length of the Marriage | Extrapolated Duration |

|---|---|

| 0 months | 0 months |

| 1 month | 1 month |

| 2 months | 1 month |

| 3 months | 1 month |

| 4 months | 1 month |

| 5 months | 2 months |

| 6 months | 2 months |

| 7 months | 2 months |

| 8 months | 2 months |

| 9 months | 3 months |

| 10 months | 3 months |

| 11 months | 3 months |

| 12 months | 3 months |

| 13 months | 4 months |

| 14 months | 4 months |

| 15 months | 4 months |

| 16 months | 5 months |

| 17 months | 5 months |

| 18 months | 5 months |

| 19 months | 6 months |

| 20 months | 6 months |

| 21 months | 6 months |

| 22 months | 7 months |

| 23 months | 7 months |

| 24 months | 7 months |

| 25 months | 8 months |

| 26 months | 8 months |

| 27 months | 8 months |

| 28 months | 9 months |

| 29 months | 9 months |

| 30 months | 9 months |

| 31 months | 10 months |

| 32 months | 10 months |

| 33 months | 10 months |

| 34 months | 11 months |

| 35 months | 11 months |

If the marriage length is less than 3 years, then the Colorado Maintenance Calculator will display the following alert message above the maintenance calculation.

Marriage Length Greater Than 20 Years

Linear extrapolation is used to determine maintenance durations from marriage lengths that exceed the upper limit of the guideline maintenance duration table, i.e. marriage lengths that are greater than 240 months. For marriages that exceed 240 months in length, the marriage length (in whole months) is divided by two and rounded up to the nearest whole number of months. If the marriage length is greater than 20 years, then the Colorado Maintenance Calculator will display the following alert message above the maintenance calculation.

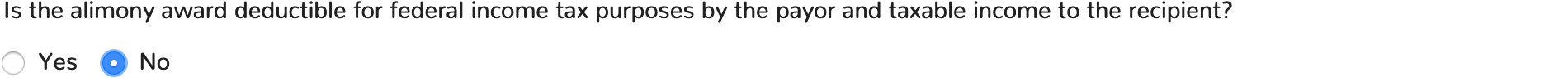

Step 4: Choose Whether Maintenance is Deductible

Fourth, you must choose whether the maintenance award is deductible for federal income tax purposes by the maintenance payor and taxable income to the maintenance recipient. If your final (not temporary) maintenance order was entered before January 1, 2019, then your maintenance payment may still be deducted from the maintenance payor's income and included in the maintenance recipient's income for federal income tax purposes. Otherwise, your maintenance payment is neither deductible by the payor nor includible to the recipient. Once you have determined the proper tax treatment, choose from one of the two available options.

Based upon your selected tax treatment and version of the Colorado maintenance guidelines, the Colorado Maintenance Calculator will determine whether the maintenance amount should be normalized. As discussed above, under the 2018 Colorado maintenance guidelines, if the maintenance award is not deductible for federal income tax purposes by the maintenance payor and not taxable income to the maintenance recipient, then the maintenance amount will be normalized downward.

Step 5: Select a Formula Version

Fifth, you must select a version of the Colorado maintenance guidelines. The selected version will be used to make your Colorado guideline maintenance calculation.

As discussed above, the Colorado maintenance guidelines became law in the year 2014. In the year 2018, the formula to calculate maintenance amounts received a substantial change. This change to the maintenance guidelines carried forward key components from the previous statutory framework. The following table displays the amount and duration formulas that comprise the two versions of the Colorado maintenance guidelines as used by the Colorado Maintenance Calculator.

| Maintenance Guidelines Version | 2014 Amount Formula | 2014 Duration Formula | 2018 Amount Formula |

|---|---|---|---|

| 01/01/2014 - 08/07/2018 | |||

| 08/08/2018 - Present |

Step 6: Make the Calculation

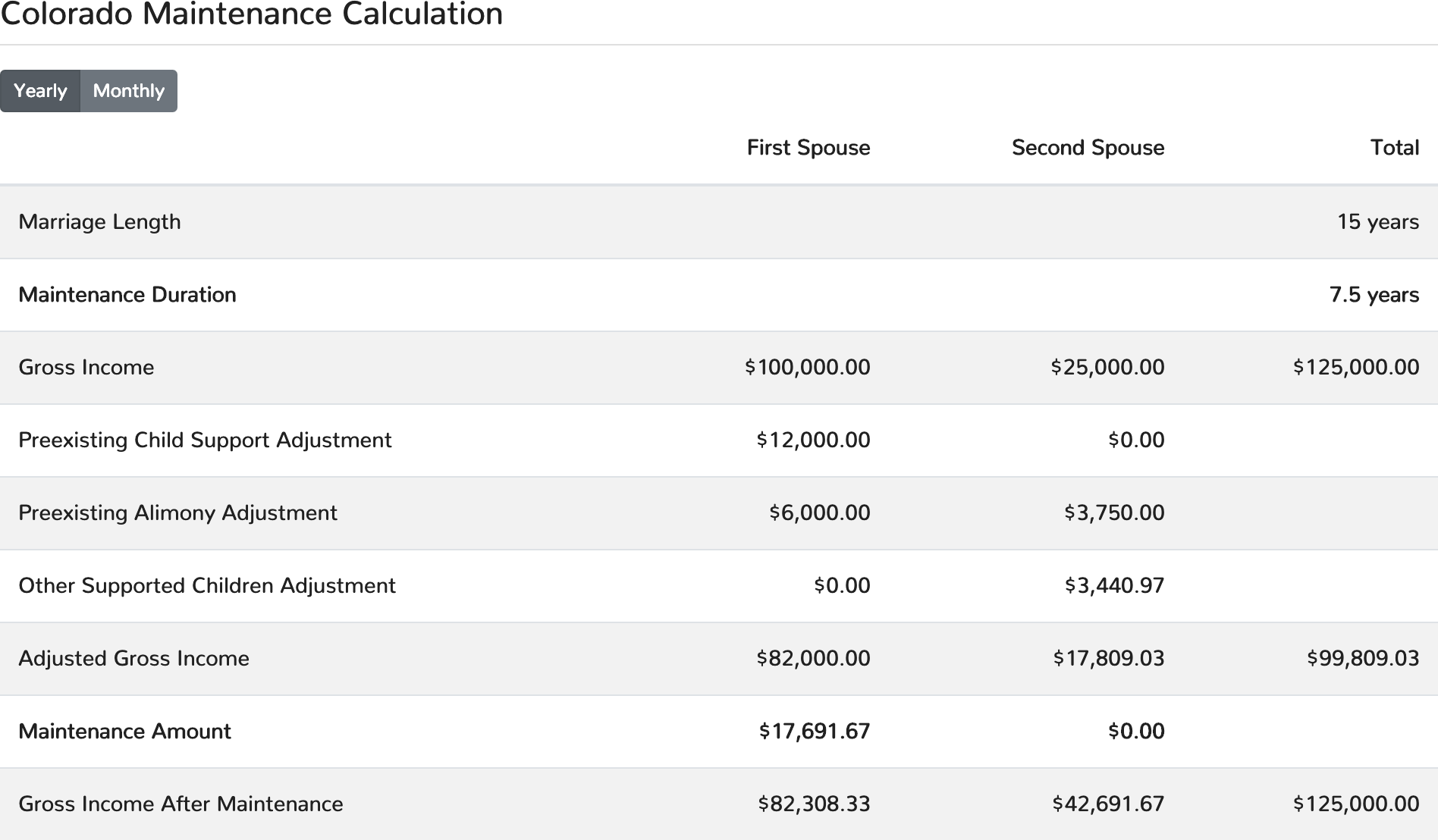

Once the spouses' gross income, income adjustment, marriage length, and tax treatment information have been entered into the Colorado Maintenance Calculator and a version of the Colorado maintenance guidelines has been selected, click the "Calculate Alimony" button. That's it! Your Colorado maintenance calculation will display on the page underneath the calculator.

Your Colorado maintenance calculation result contains both a maintenance amount and duration. By clicking on the interval buttons, you may view your result in either a yearly or monthly interval. Also, the spouses' income adjustments, adjusted gross incomes, and gross incomes after maintenance are displayed for reference.

Validation Errors

If the Colorado Maintenance Calculator was submitted with invalid information, the calculator will display validation errors on the calculator inputs that were filled out incorrectly and the "Calculate Alimony" button will be disabled. Also, error messages will be displayed below the inputs that indicate the reasons for the errors.

If you receive validation errors, enter valid information into the calculator inputs that contain the validation errors. Upon entry of new information, the validation error will be removed from the updated calculator input. Once all validation errors have been removed, the "Calculate Alimony" button will be re-enabled for resubmission of the Colorado Maintenance (Alimony) Calculator.