Calculating Kansas Maintenance (Alimony)

Learn how to make Kansas maintenance (alimony) calculations using the Kansas Maintenance Calculator.

Go CalculateUsing the Kansas Maintenance Calculator

The Kansas Maintenance (Alimony) Calculator makes Kansas maintenance calculations with one click of the mouse. Before you can calculate Kansas maintenance, however, you must enter gross income and marriage length information into the calculator.

Step 1: Enter the Gross Incomes

First, you must enter the spouses' gross incomes. Enter the gross incomes into the appropriate inputs in the Kansas Maintenance Calculator form. The gross incomes should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Kansas Maintenance Calculator uses the gross incomes entered into the calculator inputs to calculate the Kansas maintenance amount. To calculate maintenance amounts, the Kansas Maintenance Calculator uses the Johnson County (Kansas) Bar Association formula. Under the Johnson County formula, the maintenance amount is equal to 25% of the first $300,000 difference in the spouses' gross incomes plus 15% of the excess difference (more than $300,000 difference) in the spouses' gross incomes.

Step 2: Enter the Marriage Length

Second, you must enter the length of the spouses' marriage. The marriage length is the period from the date of the marriage (or the date the spouses commenced cohabitating as a financially-unified household prior to marriage) until the date of the spouses' separation or the filing date of the petition for divorce or other agreed-upon date. Once you have determined the marriage length, enter the length into the appropriate input in the Kansas Maintenance Calculator form. The length should be entered in years with no letters or special characters.

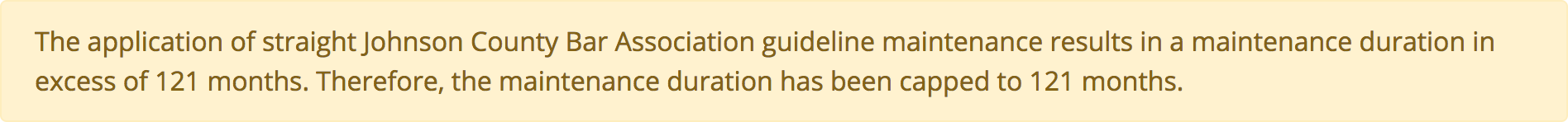

The Kansas Maintenance Calculator uses the marriage length entered into the calculator input to calculate the Kansas maintenance duration. To calculate maximum maintenance durations, the Kansas Maintenance Calculator uses a combination of both the Kansas Statutes Annotated formula and the Johnson County (Kansas) Bar Association formula. Under these formulas, the maintenance duration is equal to one-third (1/3) of the total duration of the spouses' marriage, to a maximum of 121 months. However, upon expiration of the maintenance duration and motion timely filed, a court may reinstate the maintenance payments, in whole or part, for an additional period of time not exceeding 121 months.

If the application of the Johnson County formula results in a maintenance duration in excess of 121 months, then the Kansas Maintenance Calculator will cap the maintenance duration to 121 months. The Kansas Maintenance Calculator will indicate if maintenance has been capped as follows:

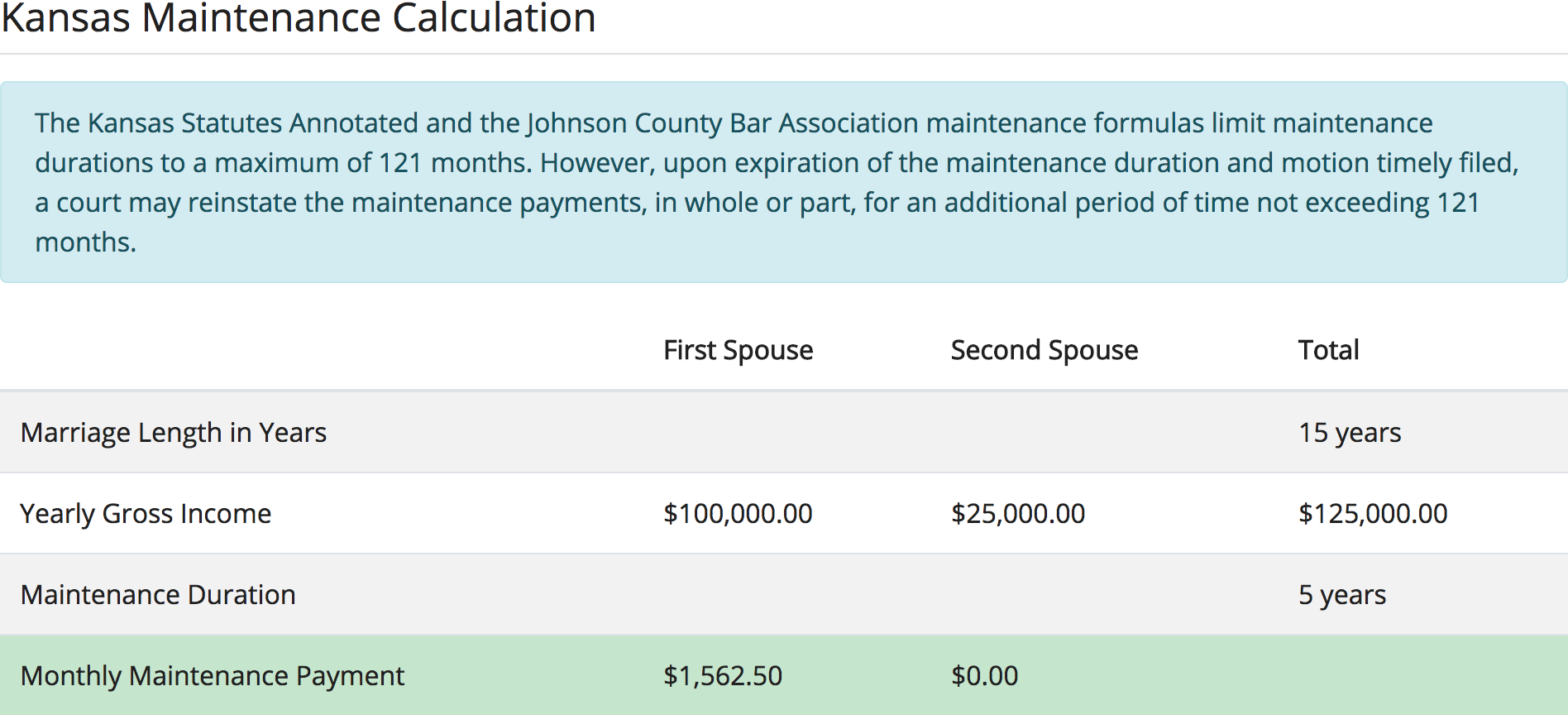

Step 3: Make the Calculation

Once the spouses' gross incomes and marriage length have been entered into the Kansas Maintenance Calculator, click the "Calculate Alimony" button. That's it! Your Kansas maintenance calculation will display on the page underneath the Kansas Maintenance Calculator.

The Kansas maintenance calculation result contains both a maintenance amount and duration, both of which are based on a combination of both the Kansas Statutes Annotated and the Johnson County (Kansas) Bar Association formulas.

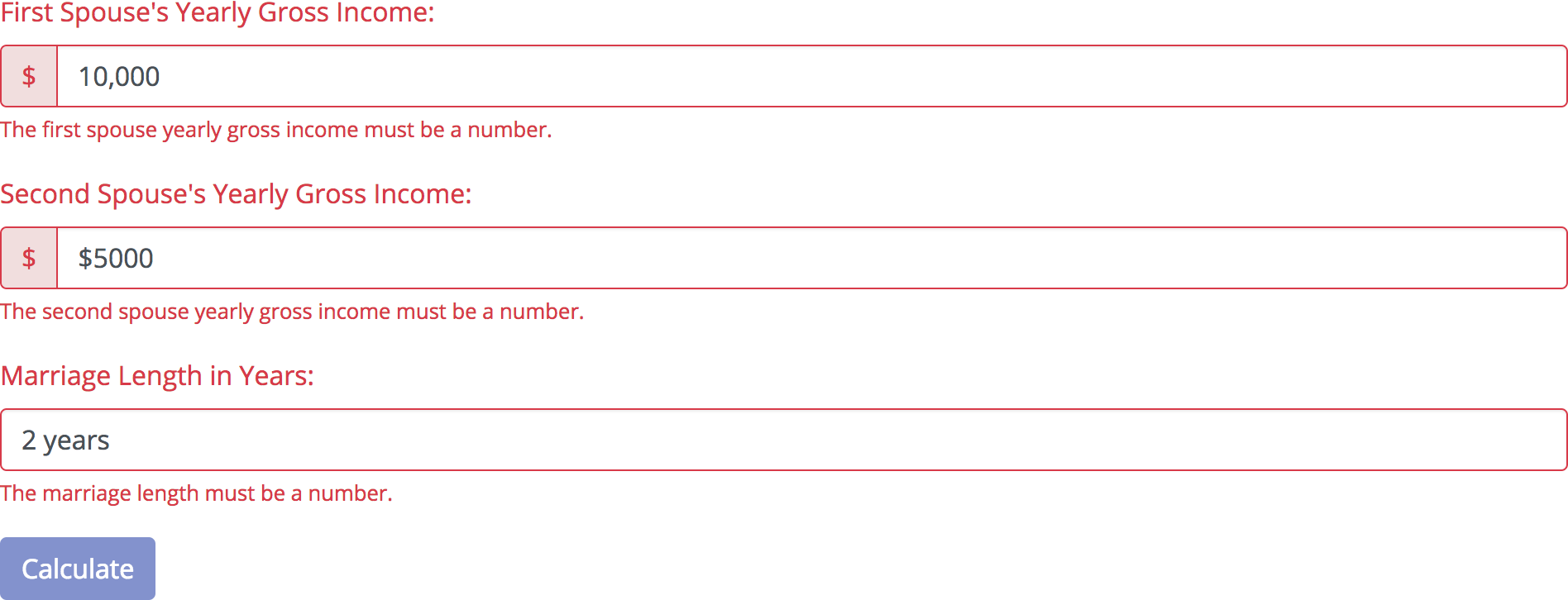

Validation Errors

If the Kansas Maintenance Calculator was submitted with invalid information, the calculator will display validation errors on the calculator inputs that were filled out incorrectly and the "Calculate Alimony" button will be disabled. Also, error messages will be displayed below the inputs that indicate the reasons for the errors.

If you receive validation errors, enter valid information into the calculator inputs that contain the validation errors. Upon entry of new information, the validation error will be removed from the updated calculator input. Once all validation errors have been removed, the "Calculate Alimony" button will be re-enabled for resubmission of the Kansas Maintenance (Alimony) Calculator.