Calculating Illinois Maintenance (Alimony)

Learn how to make Illinois maintenance (alimony) calculations using the Illinois Maintenance Calculator.

Go CalculateIntroduction to the Illinois Maintenance Guidelines

The Illinois Maintenance (Alimony) Calculator makes Illinois guideline maintenance calculations with one click of the mouse. However, because the Illinois Maintenance Calculator allows you to select from several different versions of the Illinois maintenance guidelines, you must first understand the different versions before you can effectively use the Illinois Maintenance Calculator.

Version 1: Effective January 1, 2015, through May 31, 2018

On August 15, 2014, the State of Illinois signed Public Act 098-0961 into law. This law became effective January 1, 2015, and provided formulas to calculate both maintenance amounts and durations. This law is commonly referred to as the "Illinois maintenance guidelines." Under the 2015 law, a court was required to apply the maintenance formulas when the combined gross income of the spouses was less than $250,000 and no multiple family situation existed.

2015 Amount Formula

Under the 2015 Illinois maintenance guidelines, the amount of maintenance is calculated by taking 30% of the paying spouse's gross income minus 20% of the recipient spouse's gross income. The amount calculated as maintenance, however, when added to the gross income of the recipient spouse, may not result in the recipient spouse receiving an amount that is in excess of 40% of the combined gross income of the spouses.

2015 Duration Formula

Under the 2015 Illinois maintenance guidelines, the duration of maintenance is calculated by multiplying the length of the marriage at the time the divorce case was filed by whichever of the following duration factors applies:

| Length of the Marriage | Maintenance Duration Factor |

|---|---|

| 5 years or less | 0.20 |

| More than 5 years but less than 10 years | 0.40 |

| 10 years or more but less than 15 years | 0.60 |

| 15 years or more but less than 20 years | 0.80 |

| 20 years or more | 1.00 |

Version 2: Effective June 1, 2018, through December 31, 2018

On September 22, 2017, the State of Illinois signed Public Act 100-0520 into law. This law became effective June 1, 2018, increased the gross income upper limit, and provided a more granular formula for calculating Illinois maintenance durations. Under the 2018 law, a court was required to apply the maintenance formulas when the combined gross annual income of the spouses was less than $500,000 and the paying spouse had no obligation to pay child support or maintenance or both from a prior relationship. The 2018 law did not change the formula for calculating Illinois guideline maintenance amounts.

2018 Duration Formula

Under the 2018 Illinois maintenance guidelines, the duration of maintenance is calculated by multiplying the length of the marriage at the time the divorce case was filed by whichever of the following duration factors applies:

| Length of the Marriage | Maintenance Duration Factor |

|---|---|

| Less than 5 years | 0.20 |

| 5 years or more but less than 6 years | 0.24 |

| 6 years or more but less than 7 years | 0.28 |

| 7 years or more but less than 8 years | 0.32 |

| 8 years or more but less than 9 years | 0.36 |

| 9 years or more but less than 10 years | 0.40 |

| 10 years or more but less than 11 years | 0.44 |

| 11 years or more but less than 12 years | 0.48 |

| 12 years or more but less than 13 years | 0.52 |

| 13 years or more but less than 14 years | 0.56 |

| 14 years or more but less than 15 years | 0.60 |

| 15 years or more but less than 16 years | 0.64 |

| 16 years or more but less than 17 years | 0.68 |

| 17 years or more but less than 18 years | 0.72 |

| 18 years or more but less than 19 years | 0.76 |

| 19 years or more but less than 20 years | 0.80 |

| 20 years or more | 1.00 |

Version 3: Effective January 1, 2019, through Present

On August 17, 2018, the State of Illinois signed Public Act 100-0923 into law. This law became effective January 1, 2019, accounts for the repeal of the deduction for alimony payments under the Tax Cuts and Jobs Act, and provides a new formula for calculating Illinois maintenance amounts that is based on the net incomes of the spouses. The 2019 law did not change the formula for calculating Illinois guideline maintenance durations.

2019 Amount Formula

Under the 2019 Illinois maintenance guidelines, the amount of maintenance is calculated by taking 33.33% of the paying spouse's net income minus 25% of the recipient spouse's net income. The amount calculated as maintenance, however, when added to the net income of the recipient spouse, may not result in the recipient spouse receiving an amount that is in excess of 40% of the combined net income of the spouses.

Standardized Net Income

The Illinois Department of Healthcare and Family Services has developed a standardized net income conversion table that computes net income by deducting the standardized tax amount from gross income. Standardized tax amounts consist of federal and state income tax and Social Security and Medicare tax as calculated in withholding or estimated payments. The standardized tax amount assumes each spouse files as a single person claiming the standard tax deduction, one personal exemption, and the appropiate number of dependency exemptions for the number of children supported by each spouse.

Using the Illinois Maintenance Calculator

Once you understand the basics of the Illinois maintenance guidelines, you are ready to use the Illinois Maintenance (Alimony) Calculator. To calculate Illinois guideline maintenance, you must enter gross income, child dependent, and marriage length information into the calculator and you must select a version of the Illinois maintenance guidelines.

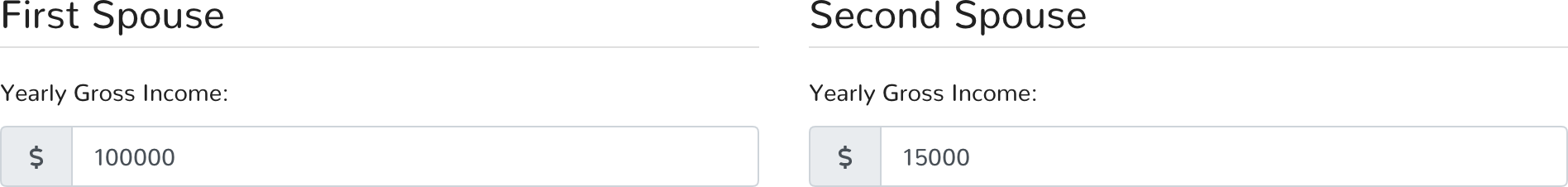

Step 1: Enter the Gross Incomes

First, you must enter the spouses' yearly gross incomes. Enter the gross incomes into the appropriate inputs in the Illinois Maintenance Calculator form. The gross incomes should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Illinois Maintenance Calculator uses the gross incomes entered into the calculator inputs to determine the spouses' standardized net incomes and calculate the Illinois guideline maintenance amount. To calculate Illinois guideline maintenance amounts, the Illinois Maintenance Calculator uses the applicable amount formula for the version of Illinois maintenance guidelines that you select. There are several different versions of the Illinois maintenance guidelines that you must select from.

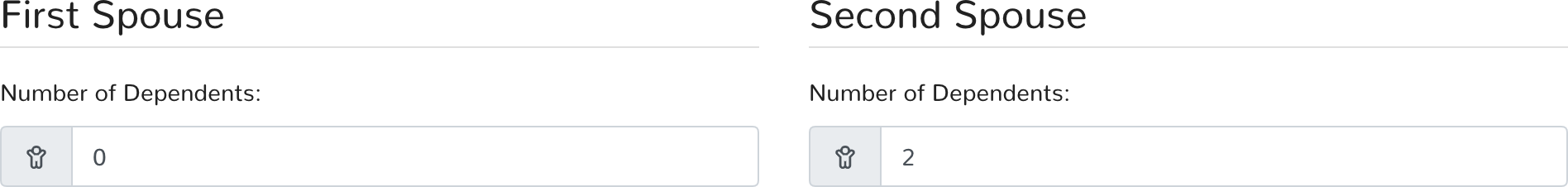

Step 2: Enter the Number of Dependents

Second, you must enter the number of dependency exemptions that each spouse may claim. Enter the number of dependents into the appropriate input in the Illinois Maintenance Calculator form. The number of dependents should be entered in whole numbers (integers) with no letters or special characters.

The Illinois Maintenance Calculator uses the number of dependents entered into the calculator inputs to determine each spouse's dependency exemptions when calculating standardized net incomes. To calculate standardized net incomes, the Illinois Maintenance Calculator uses the standardized net income conversion table. Linear extrapolation is used to determine standardized net incomes from gross incomes that exceed the upper limit of the conversion table, i.e. gross incomes that are greater than or equal to $30,025 per month. For every additional $50 of monthly gross income above the limit, an additional $29 is added to the net income values from the last row in the standardized net income conversion table.

Step 3: Enter the Marriage Length

Third, you must enter the length of the spouses' marriage. The marriage length is the period of time between the date the marriage ceremony took place and the date a spouse filed, or will be filing, for divorce. The length of time while the divorce case is pending is not included in the marriage length. Once you have determined the marriage length, enter the length into the appropriate input in the Illinois Maintenance Calculator form. The length should be entered in years with no letters or special characters.

The Illinois Maintenance Calculator uses the marriage length entered into the calculator input to calculate the Illinois guideline maintenance duration. To calculate Illinois guideline maintenance durations, the Illinois Maintenance Calculator uses the applicable duration formula for the version of Illinois maintenance guidelines that you select. There are several different versions of the Illinois maintenance guidelines that you must select from.

Step 4: Select a Formula Version

Fourth, you must select a version of the Illinois maintenance guidelines. The selected version will be used to make your Illinois guideline maintenance calculation.

As discussed above, the Illinois maintenance guidelines became law in the year 2015 and have undergone several changes since that time. In the year 2018, the formula to calculate maintenance durations was changed. Then, in the year 2019, the formula to calculate maintenance amounts was changed. Each change to the maintenance guidelines carried forward key components from the previous statutory framework. The following table displays the amount and duration formulas that comprise the several versions of the Illinois maintenance guidelines as used by the Illinois Maintenance Calculator.

| Maintenance Guidelines Version | 2015 Amount Formula | 2015 Duration Formula | 2018 Duration Formula | 2019 Amount Formula |

|---|---|---|---|---|

| 01/01/2015 - 05/31/2018 | ||||

| 06/01/2018 - 12/31/2018 | ||||

| 01/01/2019 - Present |

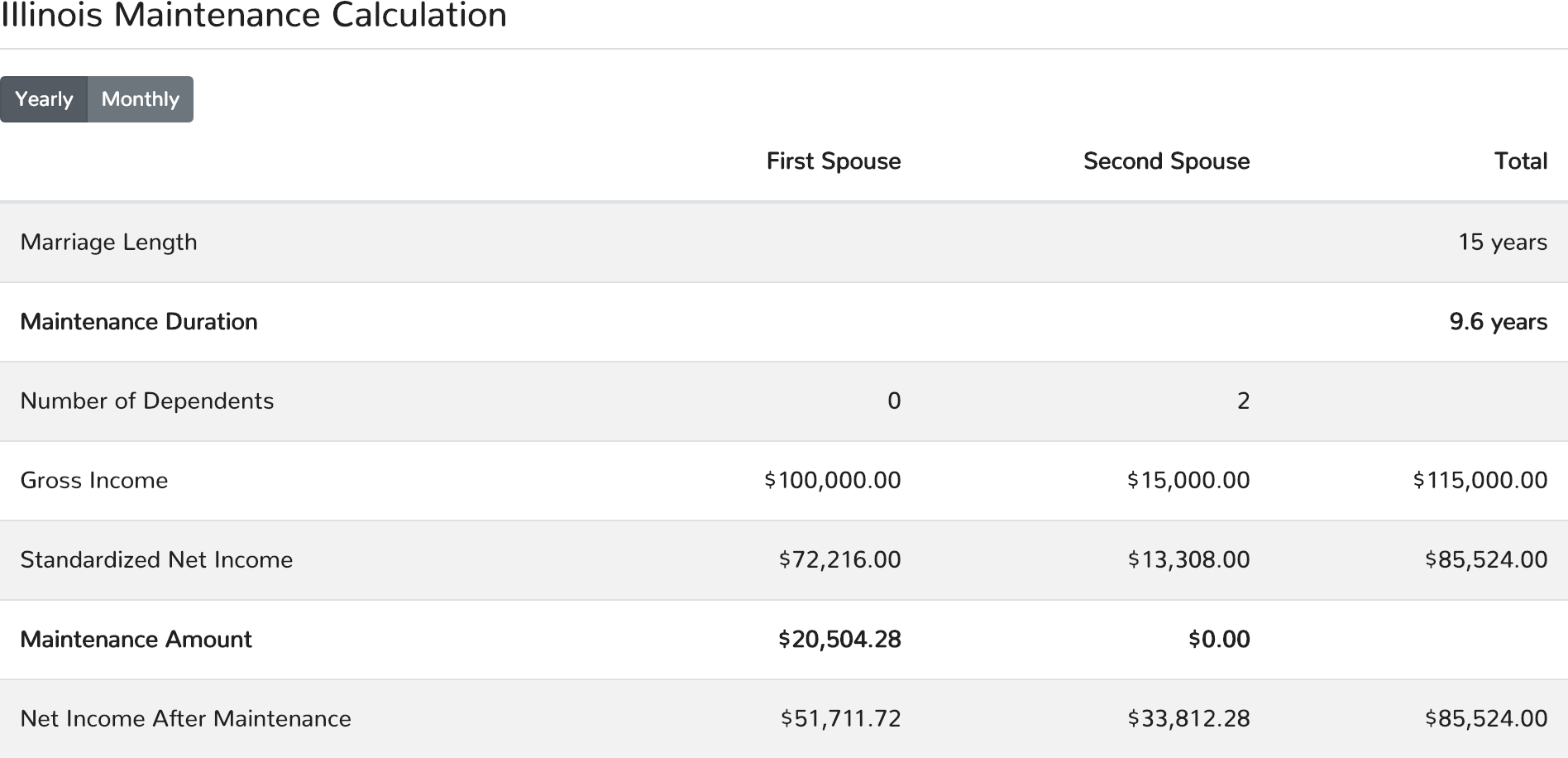

Step 5: Make the Calculation

Once the spouses' gross income, child dependent, and marriage length information have been entered into the Illinois Maintenance Calculator and a version of the Illinois maintenance guidelines has been selected, click the "Calculate Alimony" button. That's it! Your Illinois maintenance calculation will display on the page underneath the calculator.

Your Illinois maintenance calculation result contains both a maintenance amount and duration. By clicking on the interval buttons, you may view your result in either a yearly or monthly interval. Also, the spouses' standardized net incomes and net incomes after maintenance are displayed for reference.

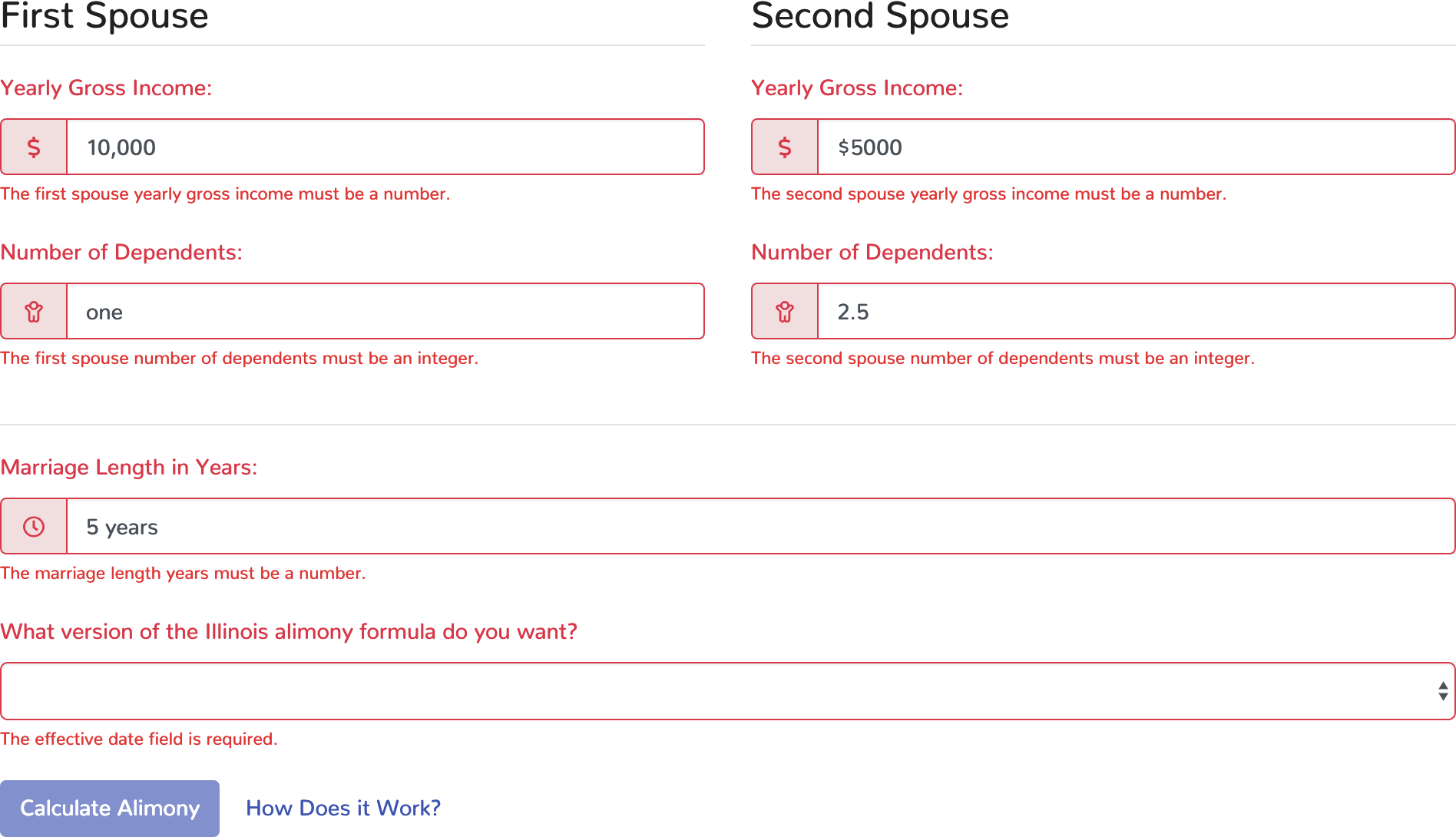

Validation Errors

If the Illinois Maintenance Calculator was submitted with invalid information, the calculator will display validation errors on the calculator inputs that were filled out incorrectly and the "Calculate Alimony" button will be disabled. Also, error messages will be displayed below the inputs that indicate the reasons for the errors.

If you receive validation errors, enter valid information into the calculator inputs that contain the validation errors. Upon entry of new information, the validation error will be removed from the updated calculator input. Once all validation errors have been removed, the "Calculate Alimony" button will be re-enabled for resubmission of the Illinois Maintenance (Alimony) Calculator.