Calculating Nevada Maintenance (Alimony)

Learn how to make Nevada maintenance (alimony) calculations using the Nevada Maintenance Calculator.

Go CalculateIntroduction to the Tonopah Alimony Formula

The Nevada Maintenance (Alimony) Calculator makes Nevada maintenance calculations with one click of the mouse. However, because the Nevada Maintenance Calculator allows you to select from two different versions of the Tonopah Alimony Formula, you must first understand the different versions before you can effectively use the Nevada Maintenance Calculator.

Net Income Amount Formula

In the year 1997, the Family Law Section of the Nevada State Bar Association proposed a formula for use by Nevada courts when determining alimony amounts and durations. The proposed formula was designed to normalize alimony awards across the State of Nevada and is commonly referred to as the "Tonopah Alimony Formula." The first version of the Tonopah Alimony Formula is based on the spouses' net incomes. It also considers the following four factors: (1) the length of the marriage; (2) the age of the alimony recipient; (3) the education level of the alimony recipient; and (4) any disability of the alimony recipient. While the spouses' net incomes are used only to calculate the alimony amount, the other four factors are used in both the alimony amount and duration calculations.

Under the Tonopah net income amount formula, the amount of maintenance is calculated by multiplying the difference between the spouses' net incomes (after deduction of child support) with a cumulative percentage. The cumulative percentage is determined according to the following rules:

- Start at 0.00 percent.

- Add 1.25 percent for every year of the marriage over 5 years.

- Add 0.50 percent for every year of age of the alimony recipient over 30 years of age.

- Add one of the following percentages based on the alimony recipient's education level:

- Add 0.00 percent if the alimony recipient has a graduate or professional degree.

- Add 2.50 percent if the alimony recipient has an undergraduate degree.

- Add 5.00 percent if the alimony recipient has completed some college.

- Add 7.50 percent if the alimony recipient is a high school graduate or less.

- Add one of the following percentages based on the alimony recipient's disability level:

- Add 0.00 percent if the alimony recipient has no disability.

- Add 2.00 percent if the alimony recipient has a partial temporary disability.

- Add 4.00 percent if the alimony recipient has a total temporary disability.

- Add 6.00 percent if the alimony recipient has a partial permanent disability.

- Add 8.00 percent if the alimony recipient has a total permanent disability.

- The cumulative percentage may not exceed 50.00 percent.

The result of the addition is the cumulative percentage. For example, if the marriage length is 7 years and the recipient spouse is 35 years old, has an undergraduate degree, and is not disabled, then the cumulative percentage is 7.50 percent.

Gross Income Amount Formula

Shortly after the creation of the Tonopah net income amount formula, a gross income amount formula was created. The Tonopah gross income amount formula was designed to eliminate the challenges of calculating the spouses' net incomes while producing similar alimony amounts as the net income formula. The four factors used in the net income formula are still utilized by the gross income formula, but their corresponding percentages where adjusted.

Under the Tonopah gross income amount formula, the amount of maintenance is calculated by multiplying the difference between the spouses' gross incomes (after deduction of child support) with a cumulative percentage. The cumulative percentage is determined according to the following rules:

- Start at 0.00 percent.

- Add 0.75 percent for every year of the marriage over 5 years.

- Add 0.375 percent for every year of age of the alimony recipient over 30 years of age.

- Add one of the following percentages based on the alimony recipient's education level:

- Add 0.00 percent if the alimony recipient has a graduate or professional degree.

- Add 2.00 percent if the alimony recipient has an undergraduate degree.

- Add 3.50 percent if the alimony recipient has completed some college.

- Add 5.00 percent if the alimony recipient is a high school graduate or less.

- Add one of the following percentages based on the alimony recipient's disability level:

- Add 0.00 percent if the alimony recipient has no disability.

- Add 1.50 percent if the alimony recipient has a partial temporary disability.

- Add 3.00 percent if the alimony recipient has a total temporary disability.

- Add 4.50 percent if the alimony recipient has a partial permanent disability.

- Add 6.00 percent if the alimony recipient has a total permanent disability.

- The cumulative percentage may not exceed 50.00 percent.

The result of the addition is the cumulative percentage. For example, if the marriage length is 7 years and the recipient spouse is 35 years old, has an undergraduate degree, and is not disabled, then the cumulative percentage is 5.375 percent.

Duration Formula

The Tonopah Alimony Formula provides a single duration formula. Under the Tonopah Alimony Formula, the duration of maintenance is based on the previously specified four factors and is determined according to the following rules:

- Start at 0.00 years.

- Add 0.375 years for every year of the marriage over 5 years.

- Add 0.10 years for every year of age of the alimony recipient over 30 years of age.

- Add one of the following durations based on the alimony recipient's education level:

- Add 0.00 years if the alimony recipient has a graduate or professional degree.

- Add 0.50 years if the alimony recipient has an undergraduate degree.

- Add 1.00 year if the alimony recipient has completed some college.

- Add 1.50 years if the alimony recipient is a high school graduate or less.

- Add one of the following durations based on the alimony recipient's disability level:

- Add 0.00 years if the alimony recipient has no disability.

- Add 1.50 years if the alimony recipient has a partial temporary disability.

- Add 3.00 years if the alimony recipient has a total temporary disability.

- Add 4.50 years if the alimony recipient has a partial permanent disability.

- Add 6.00 years if the alimony recipient has a total permanent disability.

The result of the addition is the Tonopah alimony duration. For example, if the marriage length is 7 years and the recipient spouse is 35 years old, has an undergraduate degree, and is not disabled, then the alimony duration is 1.75 years.

Using the Nevada Maintenance Calculator

Once you understand the basics of the Tonopah Alimony Formula, you are ready to use the Nevada Maintenance (Alimony) Calculator. To calculate Nevada maintenance, you must enter the required information into the calculator inputs and you must select a version of the Tonopah Alimony Formula.

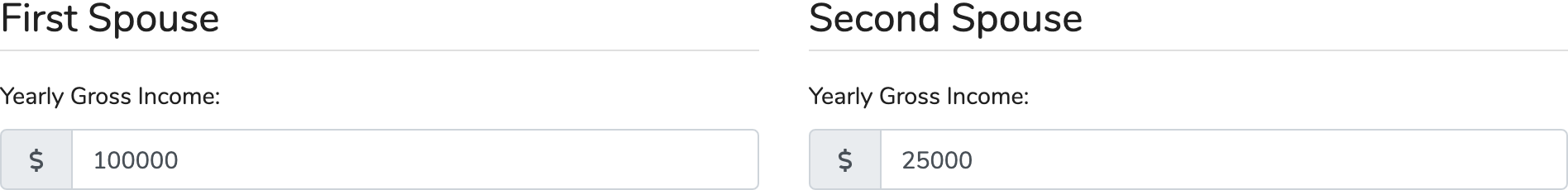

Step 1: Enter the Gross Incomes

First, you must enter the spouses' gross incomes. Enter the gross incomes into the appropriate inputs in the Nevada Maintenance Calculator form. The gross incomes should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Nevada Maintenance Calculator uses the gross incomes entered into the calculator inputs to calculate the Nevada maintenance amount. To calculate Nevada maintenance amounts, the Nevada Maintenance Calculator uses the Tonopah Alimony Formula. Under the Tonopah Alimony Formula, the amount of maintenance is calculated by multiplying the difference between the spouses' gross incomes after deduction of child support by a cumulative percentage. The cumulative percentage is determined according to specified rules as previously discussed.

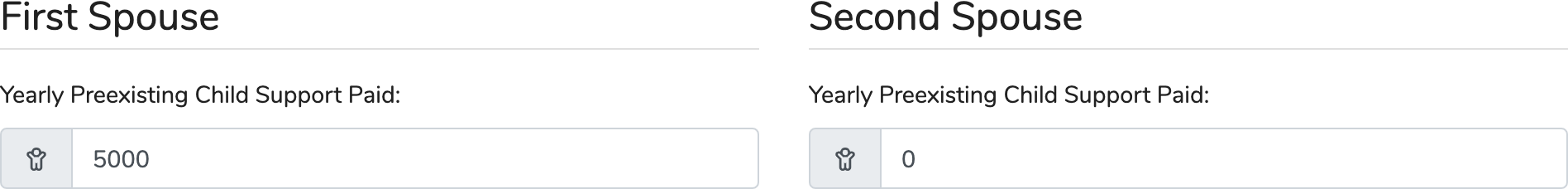

Step 2: Enter Preexisting Child Support Paid

Second, you must enter any preexisting child support paid by either spouse. Enter the preexisting child support amounts into the appropriate inputs in the Nevada Maintenance Calculator form. The preexisting child support should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Nevada Maintenance Calculator uses the preexisting child support amounts entered into the calculator inputs to adjust the spouses' gross incomes. Any preexisting child support amount entered will be subtracted from the corresponding spouse's gross income prior to calculating maintenance.

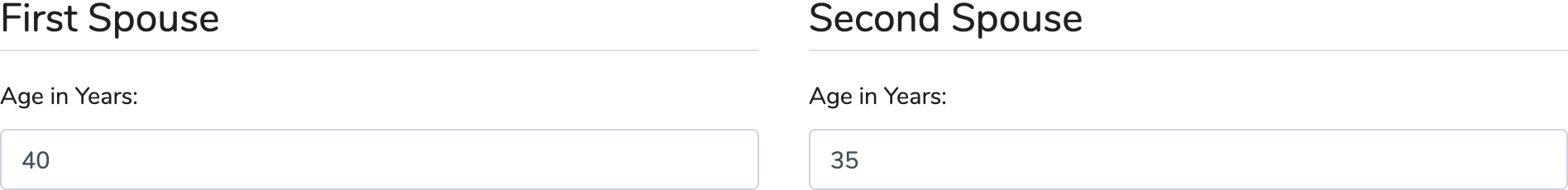

Step 3: Enter the Ages

Third, you must enter the spouses' ages. Enter the ages into the appropriate inputs in the Nevada Maintenance Calculator form. The ages should be entered in years with no letters or special characters.

The Nevada Maintenance Calculator uses the ages entered into the calculator inputs to (1) determine the percentage to be added to the cumulative percentage when calculating alimony amounts, and (2) determine the number of years to be added when calculating alimony durations. These determinations are made pursuant to the Tonopah Alimony Formula as previously discussed.

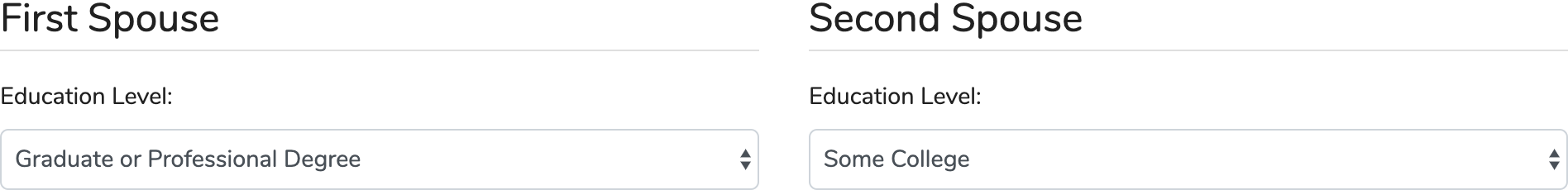

Step 4: Select the Education Levels

Fourth, you must select the spouses' education levels form the available choices. The selected education levels will be used to make your Nevada maintenance calculation.

The Nevada Maintenance Calculator uses the selected education levels to (1) determine the percentage to be added to the cumulative percentage when calculating alimony amounts, and (2) determine the number of years to be added when calculating alimony durations. These determinations are made pursuant to the Tonopah Alimony Formula as previously discussed.

Step 5: Select the Disability Levels

Fifth, you must select the spouses' disability levels form the available choices. The selected disability levels will be used to make your Nevada maintenance calculation.

The Nevada Maintenance Calculator uses the selected disability levels to (1) determine the percentage to be added to the cumulative percentage when calculating alimony amounts, and (2) determine the number of years to be added when calculating alimony durations. These determinations are made pursuant to the Tonopah Alimony Formula as previously discussed.

Step 6: Enter the Marriage Length

Sixth, you must enter the length of the spouses' marriage. Once you have determined the marriage length, enter the length into the appropriate input in the Nevada Maintenance Calculator form. The length should be entered in years with no letters or special characters.

The Nevada Maintenance Calculator uses the marriage length entered into the calculator inputs to (1) determine the percentage to be added to the cumulative percentage when calculating alimony amounts, and (2) determine the number of years to be added when calculating alimony durations. These determinations are made pursuant to the Tonopah Alimony Formula as previously discussed.

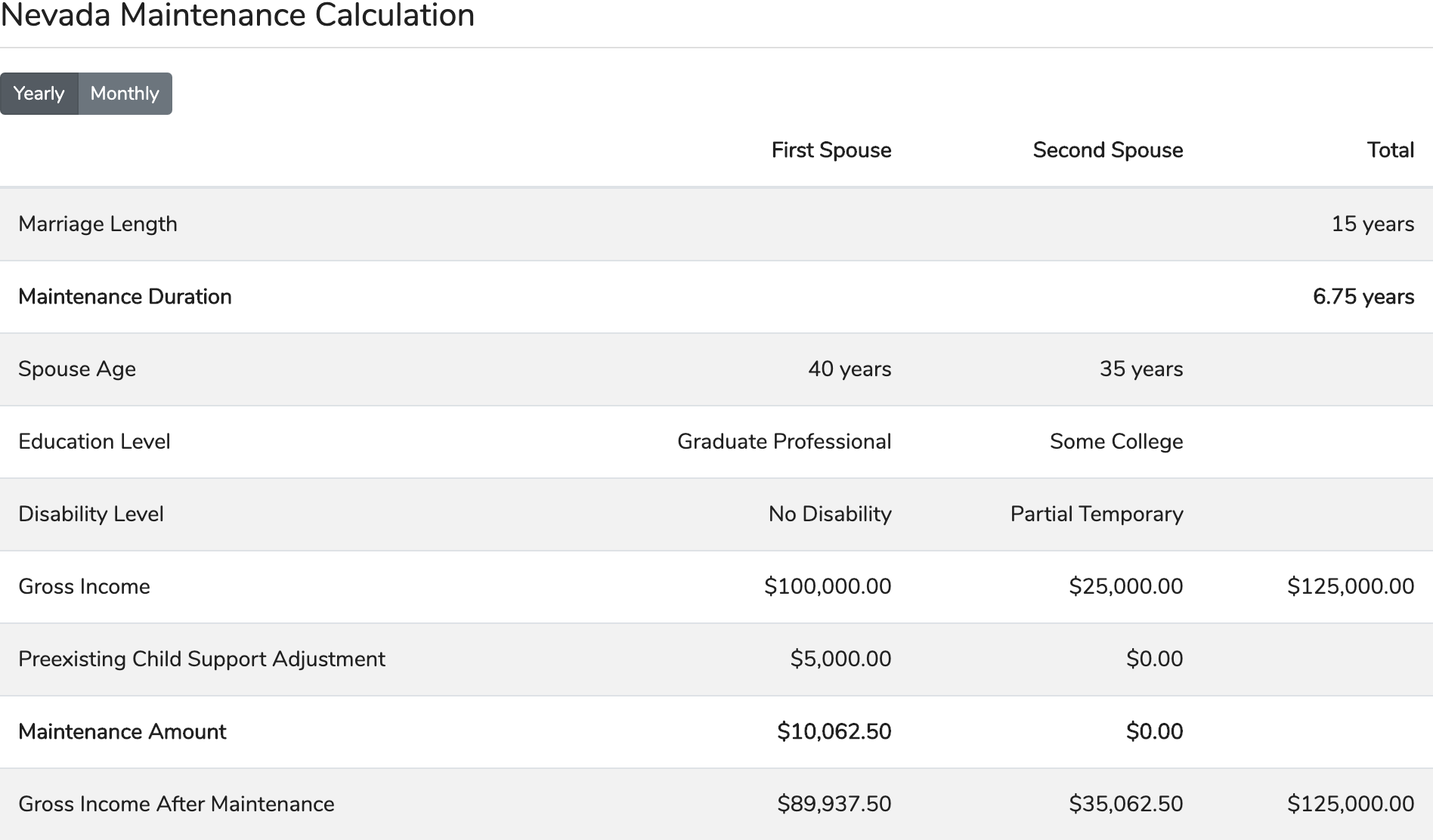

Step 7: Make the Calculation

Once the required information has been entered into the Nevada Maintenance Calculator, click the "Calculate Alimony" button. That's it! Your Nevada maintenance calculation will display on the page underneath the Nevada Maintenance Calculator.

Your Nevada maintenance calculation result is based on the Tonopah Alimony Formula and contains both a maintenance amount and duration. By clicking on the interval buttons, you may view your result in either a yearly or monthly interval. Also, the spouses' gross incomes after maintenance are displayed for reference.

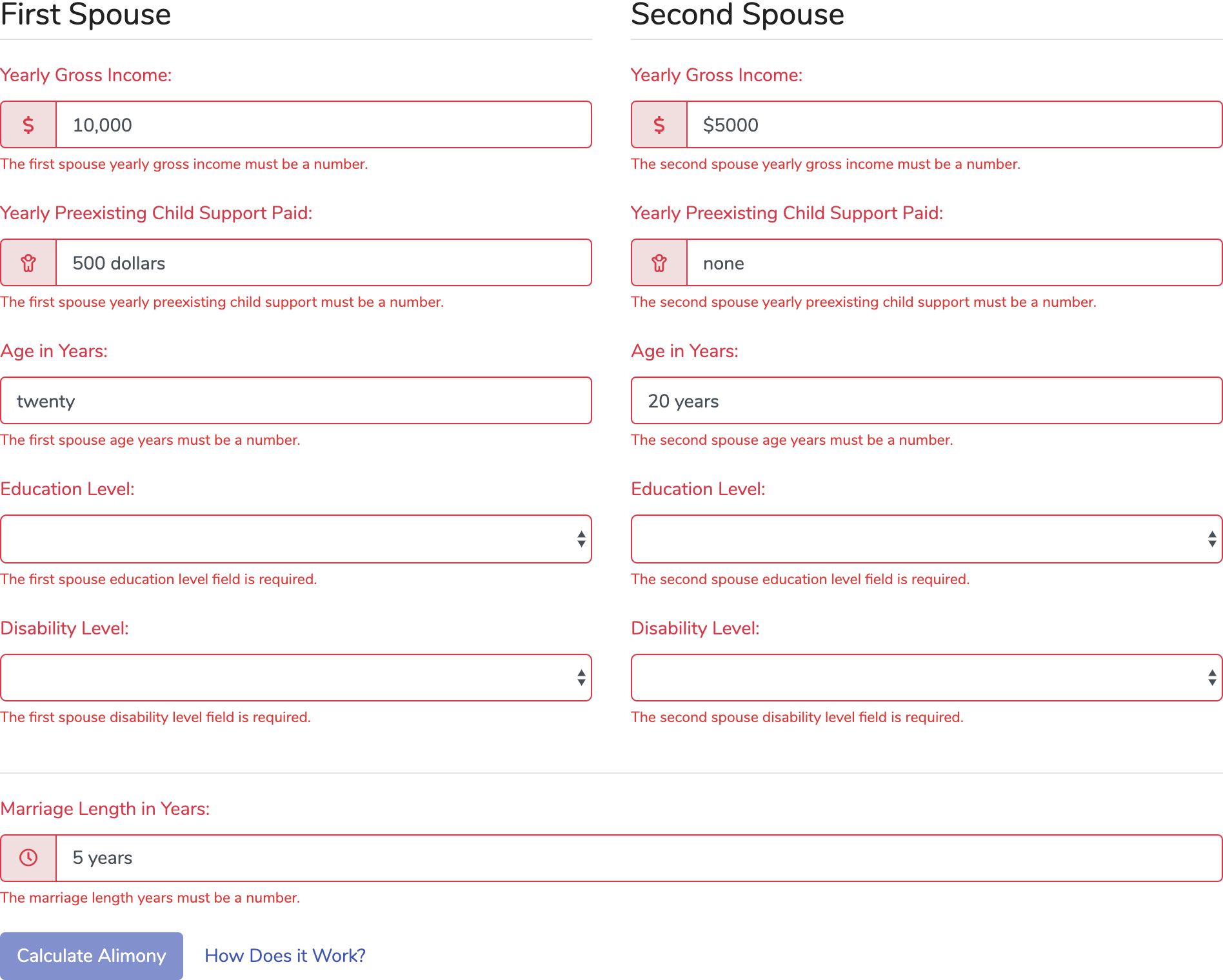

Validation Errors

If the Nevada Maintenance Calculator was submitted with invalid information, the calculator will display validation errors on the calculator inputs that were filled out incorrectly and the "Calculate Alimony" button will be disabled. Also, error messages will be displayed below the inputs that indicate the reasons for the errors.

If you receive validation errors, enter valid information into the calculator inputs that contain the validation errors. Upon entry of new information, the validation error will be removed from the updated calculator input. Once all validation errors have been removed, the "Calculate Alimony" button will be re-enabled for resubmission of the Nevada Maintenance (Alimony) Calculator.