Calculating Massachusetts Maintenance (Alimony)

Learn how to make Massachusetts maintenance (alimony) calculations using the Massachusetts Maintenance Calculator.

Go CalculateUnderstanding the Massachusetts Maintenance Types

Before you can use the Massachusetts Maintenance (Alimony) Calculator effectively, you must understand the different types of Massachusetts maintenance. Massachusetts law provides four different types of maintenance - general term, rehabilitative, reimbursement, and transitional. Each type has different parameters that determine its applicability and a different formula for calculating the maintenance amount and duration.

1. General Term Maintenance

General term maintenance is the periodic payment of support to a recipient spouse who is economically dependent. The general term maintenance amount should generally not exceed the recipient spouse's need or 30 to 35 per cent of the difference between the spouses' gross incomes established at the time of the order being issued. The maximum general term maintenance duration is calculated by multiplying the length of the marriage by whichever of the following duration factors applies:

| Length of the Marriage | General Term Maintenance Duration Factor |

|---|---|

| 5 years or less | 0.50 |

| 10 years or less, but more than 5 years | 0.60 |

| 15 years or less, but more than 10 years | 0.70 |

| 20 years or less, but more than 15 years | 0.80 |

| More than 20 years | Indefinite |

In marriages lasting more than 20 years, a court may order general term maintenance for an indefinite length of time. General term maintenance is an available option for marriages of all lengths.

2. Rehabilitative Maintenance

Rehabilitative maintenance is the periodic payment of support to a recipient spouse who is expected to become economically self-sufficient by a predicted time, such as, without limitation, reemployment; completion of job training; or receipt of a sum due from the payor spouse under a judgment. The rehabilitative maintenance amount should generally not exceed the recipient spouse's need or 30 to 35 per cent of the difference between the spouses' gross incomes established at the time of the order being issued. The duration for rehabilitative maintenance shall be not more than 5 years. Rehabilitative maintenance is an available option for marriages of all lengths.

3. Reimbursement Maintenance

Reimbursement maintenance is the periodic or one-time payment of support to a recipient spouse after a marriage of not more than 5 years to compensate the recipient spouse for economic or noneconomic contribution to the financial resources of the payor spouse, such as enabling the payor spouse to complete an education or job training. There is no formula to calculate reimbursement maintenance amounts or durations.

4. Transitional Maintenance

Transitional maintenance is the periodic or one-time payment of support to a recipient spouse after a marriage of not more than 5 years to transition the recipient spouse to an adjusted lifestyle or location as a result of the divorce. The transitional maintenance amount should generally not exceed the recipient spouse's need or 30 to 35 per cent of the difference between the spouses' gross incomes established at the time of the order being issued. The duration for transitional maintenance shall be not more than 3 years.

Using the Massachusetts Maintenance Calculator

Once you understand the basics of the Massachusetts maintenance types, you are ready to use the Massachusetts Maintenance Calculator. The Massachusetts Maintenance Calculator makes Massachusetts maintenance calculations with one click of the mouse. However, you must first properly complete the maintenance calculator form.

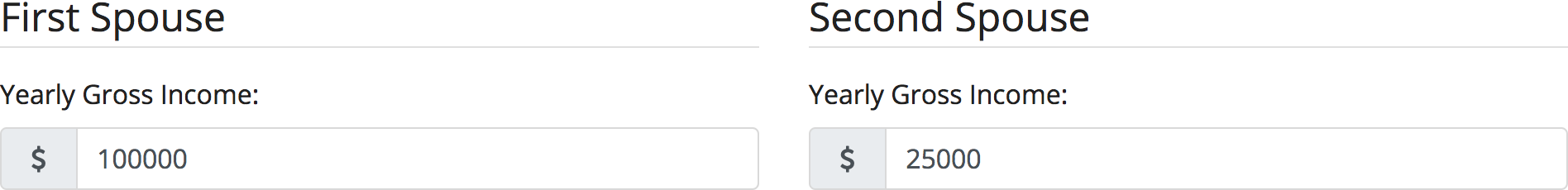

Step 1: Enter the Gross Incomes

First, you must enter the spouses' gross incomes. Enter the gross incomes into the appropriate inputs in the Massachusetts Maintenance Calculator form. The gross incomes should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Massachusetts Maintenance Calculator uses the gross incomes entered into the calculator inputs to calculate the maximum Massachusetts maintenance amount. To calculate maximum maintenance amounts, the Massachusetts Maintenance Calculator uses the appropriate formula based on the selected maintenance type.

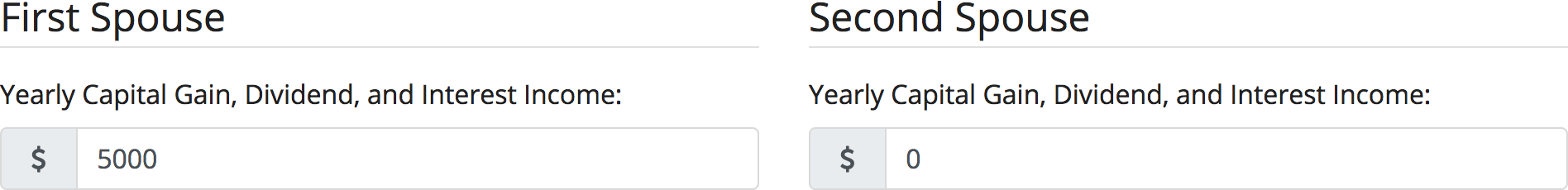

Step 2: Enter any Capital Gain, Dividend, or Interest Income

Second, you must enter any amount of capital gains income and dividend and interest income which derive from assets equitably divided between the spouses. Enter the amounts into the appropriate inputs in the Massachusetts Maintenance Calculator form. The amounts should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Massachusetts Maintenance Calculator uses the amount entered into these calculator inputs to adjust the gross incomes of the spouses. Under the Massachusetts Alimony Reform Act, when issuing an order for maintenance, a court must exclude from its income calculation capital gains income and dividend and interest income which derive from assets equitably divided between the parties. As such, the Massachusetts Maintenance Calculator subtracts any entered amount of capital gain, dividend, or interest income from the corresponding spouse's gross income.

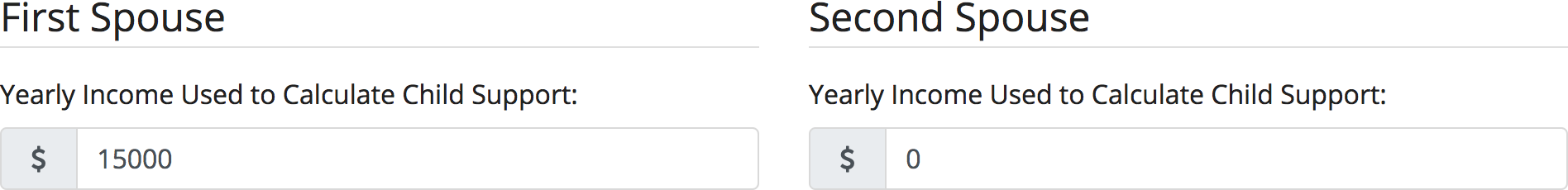

Step 3: Enter any Income Used to Calculate Child Support

Third, you must enter any amount of gross income of either spouse that a court has already considered for setting a child support order. Enter the amounts into the appropriate inputs in the Massachusetts Maintenance Calculator form. The amounts should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Massachusetts Maintenance Calculator uses the amount entered into these calculator inputs to adjust the gross incomes of the spouses. Under the Massachusetts Alimony Reform Act, when issuing an order for maintenance, a court must exclude from its income calculation gross income which the court has already considered for setting a child support order. As such, the Massachusetts Maintenance Calculator subtracts any entered amount of income previously considered for child support from the corresponding spouse's gross income.

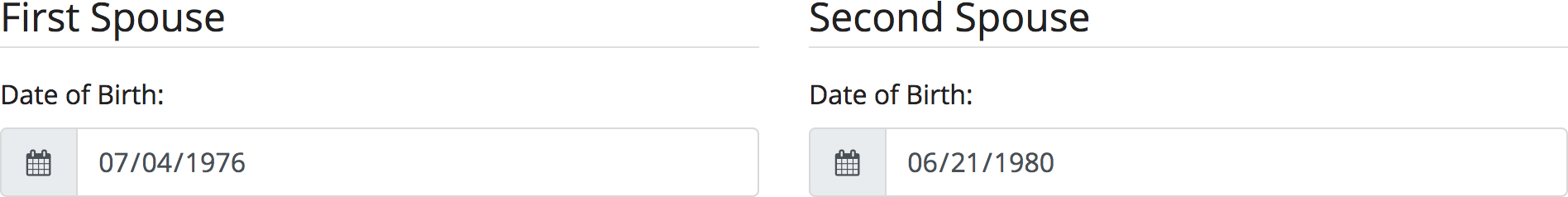

Step 4: Enter the Dates of Birth

Fourth, you must enter each spouse's date of birth. Enter the dates of birth into the appropriate inputs in the Massachusetts Maintenance Calculator form. The form will help you enter the dates in the correct format.

The Massachusetts Maintenance Calculator uses the dates of birth entered into the calculator inputs to determine the full retirement age of the payor spouse. Under the Massachusetts Alimony Reform Act, general term maintenance orders shall terminate upon the payor spouse attaining full retirement age.

Step 5: Enter the Marriage Length

Fifth, you must enter the length of the spouses' marriage. Under the Massachusetts Alimony Reform Act, the marriage length is the period of time from the date of the marriage to the date a filed divorce petition is served. A court may, however, extend this period if there is evidence that the spouses' economic marital partnership began during their cohabitation period prior to the marriage. Once you have determined the marriage length, enter the length into the appropriate input in the Massachusetts Maintenance Calculator form. The length should be entered in years with no letters or special characters.

The Massachusetts Maintenance Calculator uses the marriage length entered into the calculator input to determine whether the spouses are eligible for reimbursement or transitional maintenance. If the marriage length is greater than 5 years, then neither spouse is eligible for reimbursement or transitional maintenance, and the ability to select those maintenance types will be disabled by the calculator form. The Massachusetts Maintenance Calculator also uses the marriage length entered into the calculator input to calculate the maximum general term maintenance duration.

Step 6: Select a Maintenance Type

Sixth, you must select a Massachusetts maintenance type from the available options. If the length of the spouses' marriage is more than 5 years, then the ability to select reimbursement or transitional maintenance will be disabled.

The Massachusetts Maintenance Calculator uses the selected maintenance type to determine the appropriate formula for your Massachusetts maintenance calculation.

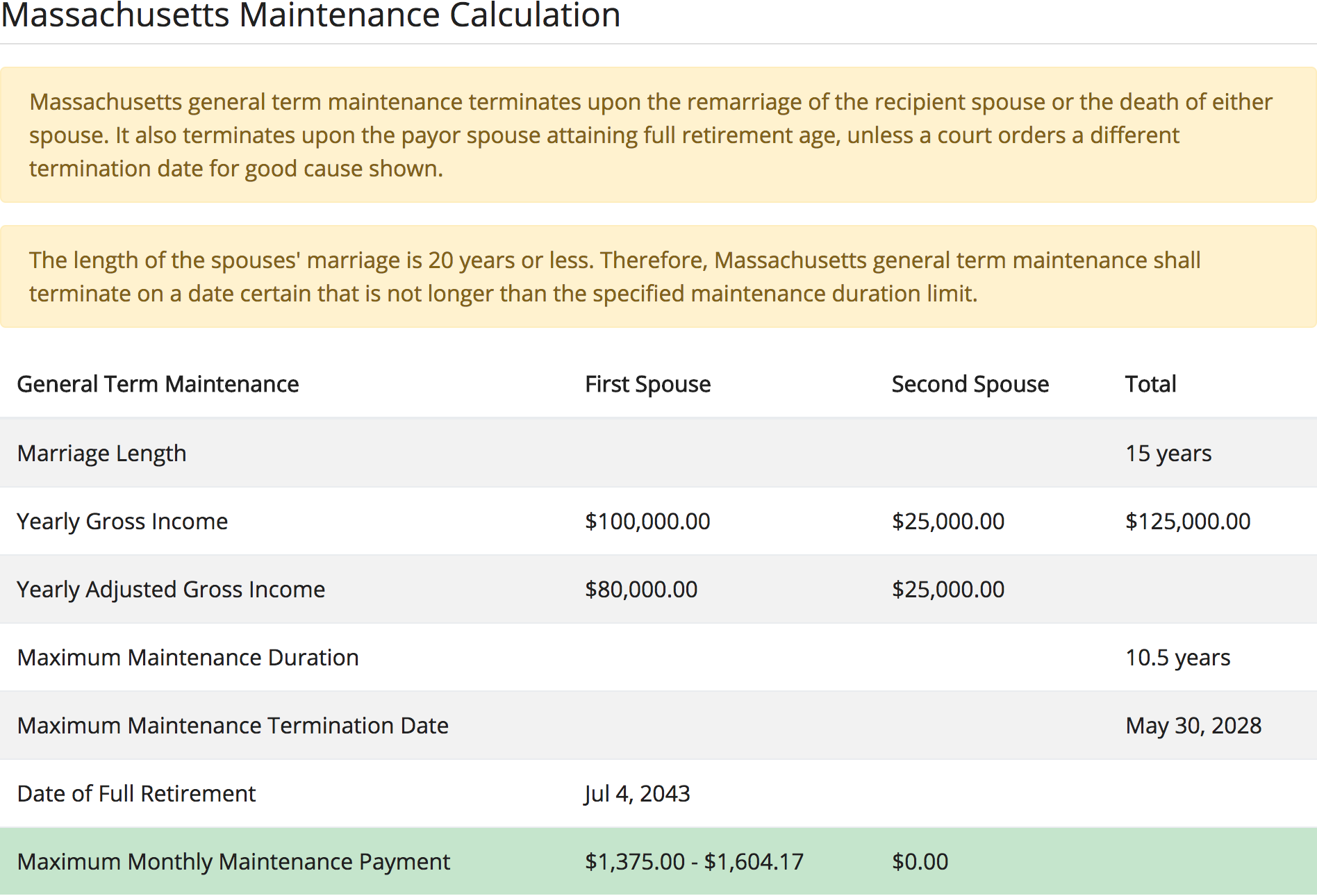

Step 7: Make the Calculation

Once you have properly completed the Massachusetts Maintenance Calculator form, click the "Calculate Alimony" button. That's it! Your Massachusetts maintenance calculation will display on the page underneath the Massachusetts Maintenance Calculator.

The Massachusetts maintenance calculation result is based on the Massachusetts Alimony Reform Act and contains the relevant information for the selected type of maintenance.

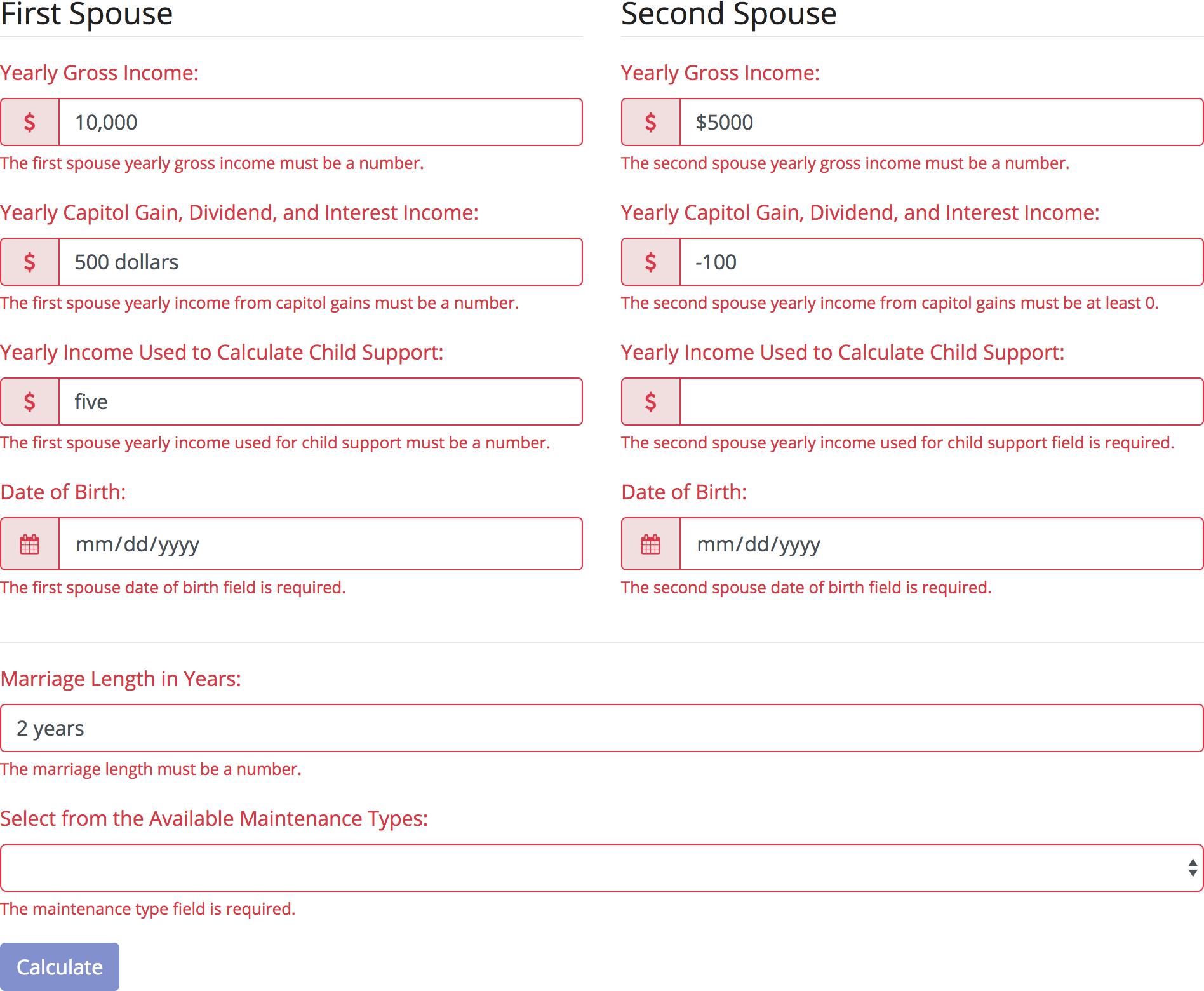

Validation Errors

If the Massachusetts Maintenance Calculator was submitted with invalid information, the calculator will display validation errors on the calculator inputs that were filled out incorrectly and the "Calculate Alimony" button will be disabled. Also, error messages will be displayed below the inputs that indicate the reasons for the errors.

If you receive validation errors, enter valid information into the calculator inputs that contain the validation errors. Upon entry of new information, the validation error will be removed from the updated calculator input. Once all validation errors have been removed, the "Calculate Alimony" button will be re-enabled for resubmission of the Massachusetts Maintenance (Alimony) Calculator.