Calculating Maintenance (Alimony) Recapture

Learn how to make maintenance (alimony) recapture calculations using the Maintenance Recapture Calculator.

Go CalculateUsing the Maintenance Recapture Calculator

The Maintenance (Alimony) Recapture Calculator makes maintenance recapture calculations with one click of the mouse. Before you can calculate maintenance recapture, however, you must enter maintenance payment information into the calculator.

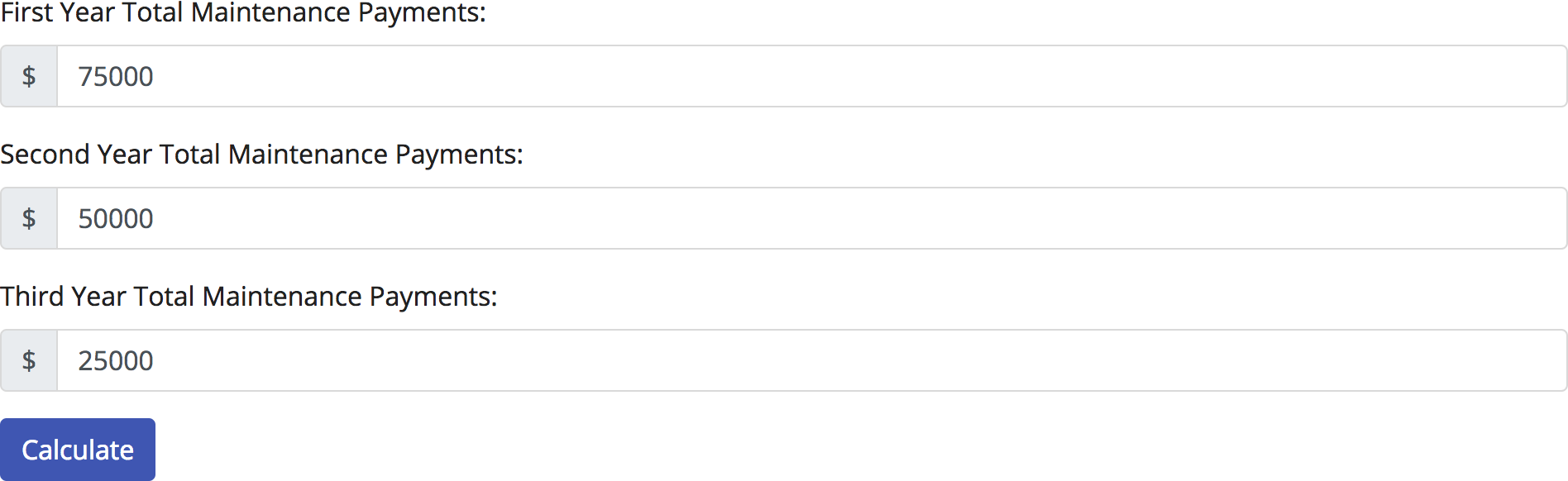

Step 1: Enter the Maintenance Payments

First, you must enter the total maintenance payments for each of the first three calendar years following the first qualifying maintenance payment. Enter the total maintenance payments into the appropriate inputs in the Maintenance Recapture Calculator form. The maintenance payments should be entered in dollar amounts with no letters or special characters, such as the dollar symbol or commas.

The Maintenance Recapture Calculator uses the maintenance payments entered into the calculator inputs to calculate the maintenance recapture amount. To calculate maintenance recapture amounts, the Maintenance Recapture Calculator uses the maintenance recapture formula.

Step 2: Make the Calculation

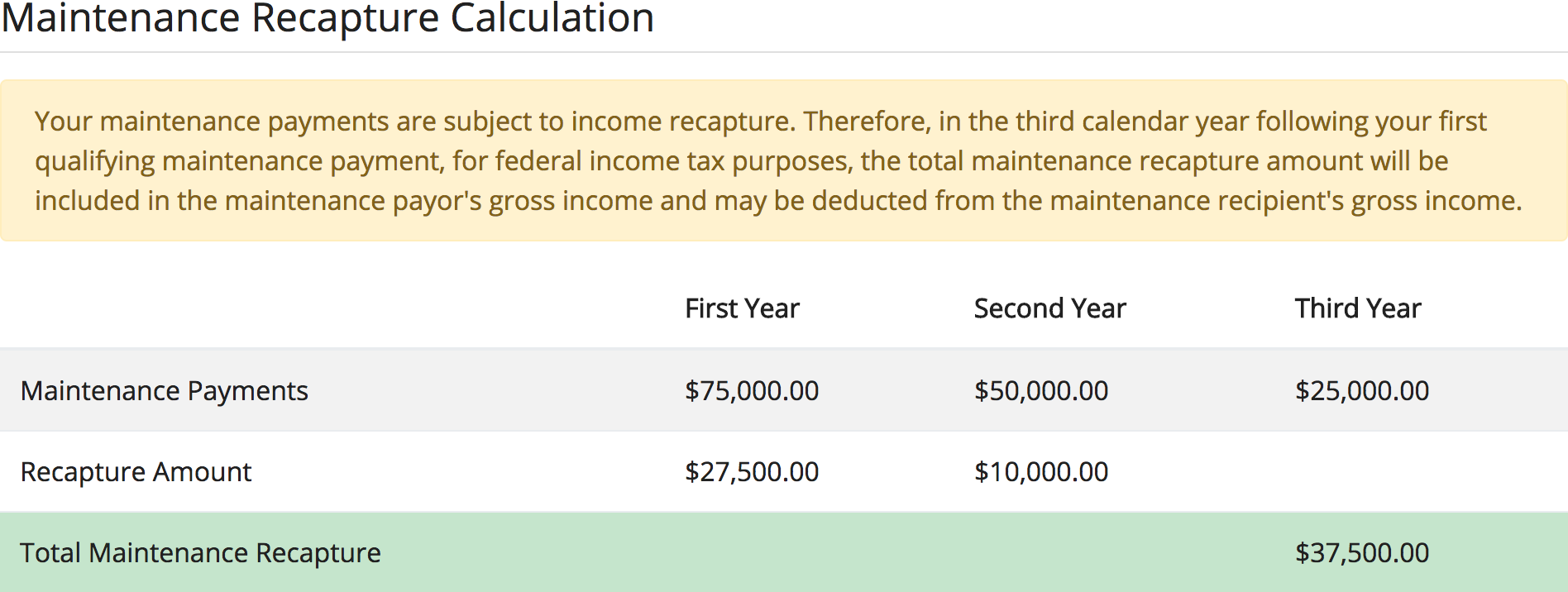

Once the maintenance payments have been entered into the Maintenance Recapture Calculator, click the "Calculate Recapture" button. That's it! Your maintenance recapture calculation will display on the page underneath the Maintenance Recapture Calculator.

The maintenance recapture calculation result contains a total recapture amount, as well as, the recapture amounts for both the first and second years individually. The calculation result is based on the maintenance recapture formula. If the entered maintenance payments are not subject to income recapture, the Maintenance Recapture Calculator will indicate as follows:

However, if the entered maintenance payments are subject to income recapture, the Maintenance Recapture Calculator will indicate as follows:

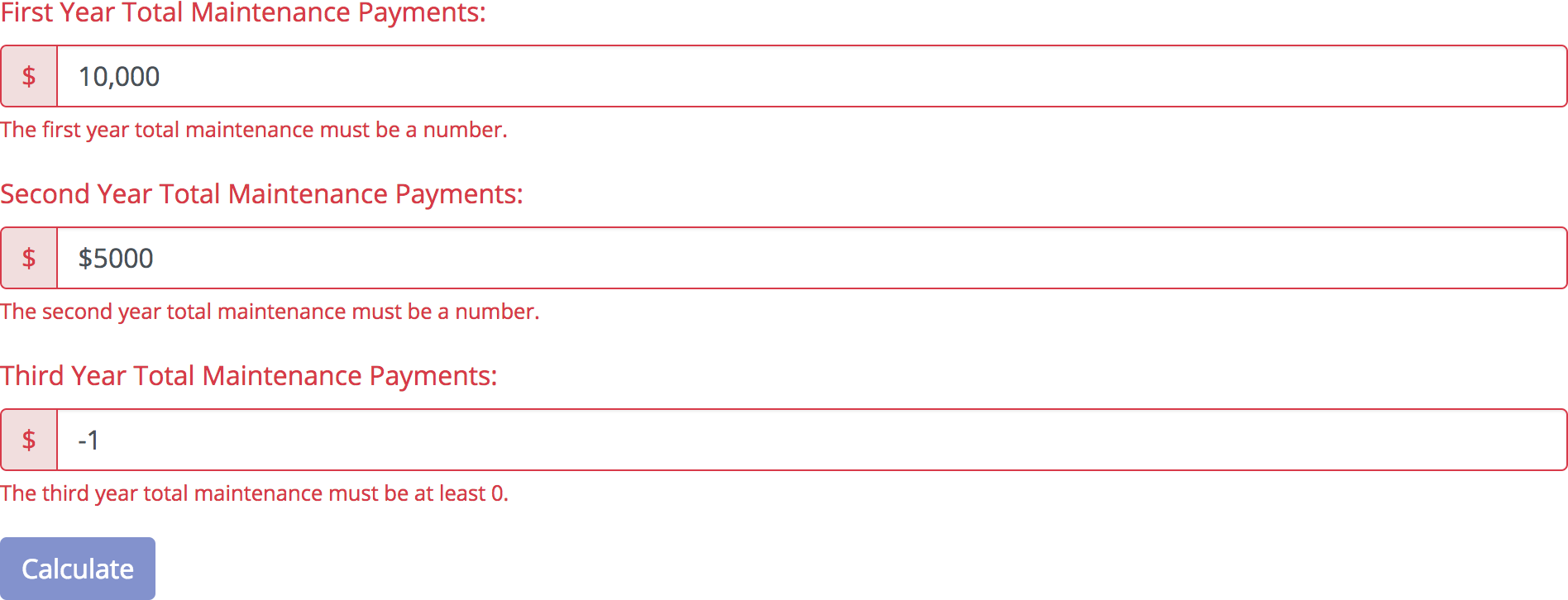

Validation Errors

If the Maintenance Recapture Calculator was submitted with invalid information, the calculator will display validation errors on the calculator inputs that were filled out incorrectly and the "Calculate Recapture" button will be disabled. Also, error messages will be displayed below the inputs that indicate the reasons for the errors.

If you receive validation errors, enter valid information into the calculator inputs that contain the validation errors. Upon entry of new information, the validation error will be removed from the updated calculator input. Once all validation errors have been removed, the "Calculate Recapture" button will be re-enabled for resubmission of the Maintenance (Alimony) Recapture Calculator.

Understanding Maintenance Recapture

Although you do not need to understand maintenance recapture in order to use the Maintenance Recapture Calculator, a basic understanding of the maintenance recapture rules and formula will help you understand your maintenance recapture calculation.

Maintenance Recapture Rules

The United States maintenance recapture rules are found in section 71 of the Internal Revenue Code and call for the recalculation of the spouses' gross incomes where there is excess "front-loading" of maintenance payments. The maintenance recapture rules apply when maintenance payments decrease excessively during the first three calendar years following the first maintenance payment made pursuant to a decree of divorce or separate maintenance or a separation agreement.

The maintenance recapture rules apply to the first three calendar years of qualifying maintenance payments. For example, assume the spouses were divorced on December 30, 2010, the first maintenance payment was made on December 31, 2010, and the second maintenance payment was made on January 1, 2011. In this example, the year 2010 will be treated as the 1st calendar year, the year 2011 will be treated as the 2nd calendar year, and the year 2012 will be treated as the 3rd calendar year.

To determine if maintenance payments have been excessively front-loaded, the maintenance payments made during the 3rd year are compared against the maintenance payments made in the 1st and 2nd years individually. If the maintenance payments made in the 1st or 2nd year are found to be excessive, then the excess is recaptured. The recapture amount represents the part of the maintenance payments that should have been originally classified as a property distribution.

If maintenance payments made in the 1st or 2nd years are subject to income recapture, the maintenance payor must add the total recapture amount for the 1st and 2nd years combined to their gross income when they file their federal income taxes for the 3rd calendar year. The maintenance recipient has the option to deduct the total recapture amount from their gross income when they file their federal income taxes for the 3rd calendar year.

The Maintenance Recapture Formula

The maintenance recapture formula compares the total maintenance payments made during the 3rd calendar year against the total maintenance payments made in the 1st and 2nd calendar years individually. If the total maintenance payments made in either the 1st or 2nd calendar year are found to be excessive, then the excess is recaptured in the 3rd year.

The easiest way to calculate the total recapture amount is to first calculate the 2nd year recapture amount. Next, calculate the 1st year recapture amount. Finally, add the 1st and 2nd year recapture amounts together.

Second Year Recapture Amount

To calculate the 2nd year recapture amount, first subtract the 2nd year maintenance payments from the 3rd year maintenance payments. Next, subtract $15,000 from that amount. If the result is a positive number, then that is the 2nd year recapture amount. Otherwise, the 2nd year recapture amount is zero.

An example is displayed in the table below. In the example, it is assumed that maintenance payments totaled $50,000 for the 2nd year and totaled $25,000 for the 3rd year.

| Calculating the 2nd Year Recapture Amount | |

|---|---|

| 2nd Year Maintenance Payments | $50,000 |

| 3rd Year Maintenance Payments | - $25,000 |

| Threshold | - $15,000 |

| 2nd Year Recapture Amount | $10,000 |

First Year Recapture Amount

The calculation for the 1st year recapture amount is more complex than that for the 2nd year. First, we need to calculate the average maintenance paid for the 2nd and 3rd years. To calculate the average, add the total maintenance payments for the 2nd and 3rd years together and then subtract the 2nd year recapture amount from that sum. Divide the result by 2 to achieve the average maintenance paid for the 2nd and 3rd years.

Next, subtract the 2nd and 3rd year average from the 1st year maintenance payments, and then subtract $15,000.00 from that amount. If the result is a positive number, then that is the 1st year recapture amount. Otherwise, the 1st year recapture amount is zero.

Our example is continued in the table below, which shows how to calculate the 1st year recapture amount. In the example, it is assumed that maintenance payments totaled $75,000 for the 1st year.

| Calculating the 1st Year Recapture Amount | |

|---|---|

| 2nd Year Maintenance Payments | $50,000 |

| 3rd Year Maintenance Payments | + $25,000 |

| 2nd Year Recapture Amount | - $10,000 |

| $65,000 | |

| Divide by 2 | % 2 |

| 2nd and 3rd Year Average Payment | $32,500 |

| 1st Year Maintenance Payments | $75,000 |

| 2nd and 3rd Year Average Payment | - $32,500 |

| Threshold | - $15,000 |

| 1st Year Recapture Amount | $27,500 |

Total Recapture Amount

Don't sweat, the hard part is done. To calculate the total recapture amount, simply add the 1st and 2nd years recapture amounts together. In the third year, the maintenance payor must include that amount back into their gross income for federal income tax purposes and the maintenance recipient may deduct that amount from their gross income for federal income tax purposes. The table below shows the total recapture amount for our example.

| Calculating the Total Recapture Amount | |

|---|---|

| 1st Year Recapture Amount | $27,500 |

| 2nd Year Recapture Amount | + $10,000 |

| Total Maintenance Recapture | $37,500 |

Maintenance Recapture Exceptions

The general rule is that if there are excess maintenance payments in the first three calendar years of maintenance payments following a separation or divorce then the excess will be recaptured during the third calendar year for federal income tax purposes. However, there are several important exceptions to this rule where the excess will not be recaptured. The exceptions to the maintenance recapture rule are defined in section 71(f) of the Internal Revenue Code. Let's take a look at each of the exceptions.

1. Where Maintenance Ceases by Reason of Death

Maintenance will not be recaptured if either spouse dies before the close of the 3rd post-separation year. Maintenance payments must stop by reason of such death.

2. Where Maintenance Ceases by Reason of Remarriage

Maintenance will not be recaptured if the spouse who is receiving maintenance remarries before the close of the 3rd post-separation year and maintenance payments stop because of the remarriage. This exception does not apply where maintenance payments stop because of the cohabitation of the recipient spouse.

3. Temporary Orders

Maintenance that is paid pursuant to a temporary order will not be recaptured. For example, a court may enter a temporary maintenance order during the pendency of a divorce case. Maintenance payments made under that order would not be subject to recapture.

4. Fluctuating Payments Not Within Control of Payor Spouse

Maintenance that is paid based on a fixed percentage of the maintenance payor’s income from their business, property, or employment compensation will not be recaptured. This obligation to pay a fixed portion must continue for at least 3 full (not calendar) years.

As you can see, there are only a few exceptions where excess front-loaded maintenance payments are not subject to recapture, and most of the exceptions are triggered where circumstances outside of the maintenance payor’s control cause the maintenance payments to decrease or stop. Nevertheless, knowledge of these exceptions is crucial for both maintenance payors and recipients.

Next Steps...

Although the math involved with calculating maintenance recapture amounts is not complex, if you are not reaching for this formula every day it can be hard to remember. There are several steps that must be followed and intermediate calculations that must be made.

At this point, further familiarize yourself with the formula by working through several examples on your own. Once you have gotten the hang of it, use the Maintenance (Alimony) Recapture Calculator to make all future maintenance recapture calculations. This will speed up your workflow and allow you to make maintenance recapture calculations with ease and confidence.